In reality, there is no one-size-fits-all maintenance regimen. Some engines, like those using landfill or wastewater treatment digester gas, may require shorter maintenance and overhaul intervals due primarily to fuel quality. On the other hand, engines operating on clean natural gas typically need less frequent maintenance: Operators can safely extend the published intervals without increased risk by using trend analysis. The following are essential items to monitor.

LUBRICATING OIL

Lube oil is easy to take for granted, and yet it is an engine’s lifeblood. Oil accounts for a large share of maintenance costs, but it is also critically important, both for what it does to protect your engines and for what it reveals about the engines’ condition.

OIL SELECTION

Good maintenance starts with choosing the right oil for your engines and application – one that delivers the necessary oil life and component protection. Choosing oil for industrial engine-generators is more complicated than grabbing the nearest can of 5W-30 from the auto parts store.

Engine manufacturers issue model- and application specific oil specifications for such qualities as ash content, lubricity and operating temperature. Oils contain a variety of additives designed to add oil stock stability under a range of operating conditions, resist acidification and extend oil life. New oil chemistries reach the market frequently. It is prudent to choose an oil supplier that has a history with your engine manufacturer and understands the lubrication requirements of your engine in your specific application.

OIL ANALYSIS

Oil analysis is possibly the most valuable engine trending tool. An engine oil analysis is similar to a medical blood test, and just as important for assessing your engines’ health. The results of the engine oil analysis provide vital information that helps you set the most appropriate oil change interval – and can alert you to potential trouble.

A key engine health indicator in natural gas engine oil is metals – iron, chromium and copper. The presence of these, and their levels, typically stated in parts per million (ppm), help indicate which components are wearing as expected and which are experiencing abnormal wear. Analysis can also detect the presence of harmful acids, indicated by a declining total base number (TBN), which is a measure of buffering capacity, and a rising total acid number (TAN), a measure of acid content. (TAN is not typically included in basic oil analyses and must be specifically requested.) Analysis also detects glycol, indicating coolant leakage, and silicon, likely signaling an air leak in the air intake system or a damaged air filter.

Oil life is a function of the volume of oil in the engine, engine operating load, ambient conditions and the quality of the fuel. Oil can safely remain in the engine until some measurement reaches its condemning limit as set by the engine manufacturer. In engines fueled with pipeline gas, the most common condemning limit is oxidation, a gradual oil breakdown caused by heat. Next most common is nitration, caused by incomplete combustion or by fuel contaminants. Oil analysis can be used to trend both conditions.

An oil analysis regimen should begin with the testing of a clean (unused) sample of the oil you plan to use. All oils have different additive packages and oil chemistries; they need to be evaluated and the resulting chemistries known before the oil is used in an engine. The results of the clean-oil test provide a baseline against which to compare analyses of future used oil samples.

Used oil then should be analyzed every 250 operating hours up until the first oil change to establish the parameter that will set the condemning limit and to identify the trend for the specific oil formulation. Technicians should take samples while the oil is warm and well mixed to ensure that the sample truly represents the condition of oil in the crankcase.

Next, oil should be analyzed at one-half the expected life to verify the trend initially seen. Once the condemning limit is verified, it is prudent to reduce the change interval slightly to establish a safety factor. Once you establish clear trends, sample the oil at every change to verify that the trends are holding.

Be sure to note the total number of hours on the oil sampled – the age of the oil will greatly influence the analysis results. High-quality analysis laboratories list the latest test results side-by-side with the previous. They also have a trained and certified oil technician who knows the specific engine model reviewing the results, looking for abnormalities, and advising the owner on how things are trending.

A few other key points to remember about oil and analysis:

- �Just as no two people have identical blood chemistries or blood pressure, no two engines run exactly the same way or have exactly the same wear characteristics – not even two of the same model on the same site. What is normal for one engine may not be exactly the same for another, so trend engines individually.

- In reviewing oil analyses, consider contaminants that may come not from within the engine but from the surrounding environment. For example, operating in a dirty area may elevate silicon; operating near a chemical plant that emits chlorine compounds could speed up oil acidification.

- Before sending an oil sample, examine it carefully. If you see large wear particles or anything else abnormal, let your laboratory know and look for clues to the cause.

- �There are benefits to using original equipment oil filters and subscribing to your engine manufacturer’s oil analysis service. In that event, factory-qualified technicians perform the analysis and are trained to correctly interpret the results, and warranty support is enhanced: If an engine manufacturer’s oil filter should fail through defect, the manufacturer may cover not only the failed filter but also consequential damage to the engine.

SPARK PLUGS

Properly performing spark plugs are critical to gas engine performance, fuel economy and emissions. Today’s advanced lean-burn engines may use traditional J-gap spark plugs or prechamber plugs. In the prechamber design, the spark plug admits air and fuel to a small chamber around the electrode by way of small orifices. Upon ignition, the prechamber protects the flame from being “blown out” by turbulence in the cylinder. The growing flame is then ejected through the orifices to ignite the full cylinder’s air-fuel charge.

Spark plug wear varies greatly with engine load factor, fuel quality and other factors. J-gap plug life, for example, may range from 3,000 to 5,000 hours in low-compression engines and from 2,000 to 4,000 hours in high-compression engines.

As with oil, spark plug change intervals can extend beyond the intervals listed in the owner’s manual. Good trend data can help operators set the optimum change interval for a specific installation. J-gap plugs must be regapped to the proper specification at each service. Operators can monitor and track trends in spark plug wear by measuring and recording the gap at each service and by observing the plugs' general condition. Good maintenance practice calls for regular cleaning of the spark plug electrodes.

Plug performance also can be trended by monitoring secondary transformer output, which usually reads out as percentages from the engine software or through the SCADA system. A new spark plug typically registers at about 25 percent. As the plug ages, the electrode deteriorates, increasing the gap and thus the voltage required for the spark to jump across terminals. Plug failure begins as secondary voltage surpasses 90 percent – this makes it easy to arrive at the optimum time for regapping or replacement.

If the engine is unstable or running poorly, a check of exhaust port temperatures is a good start to troubleshooting. A drop in temperature indicates a plug that has failed or is misfiring. Deciding when to replace all plugs is a judgment call. In general, if just one plug fails, especially if it fails far from the expected change interval, it is more cost-effective to replace only that plug. However, when three or more plugs have failed, especially with a short time, that is a reliable sign that all plugs are approaching end of life.

VALVES

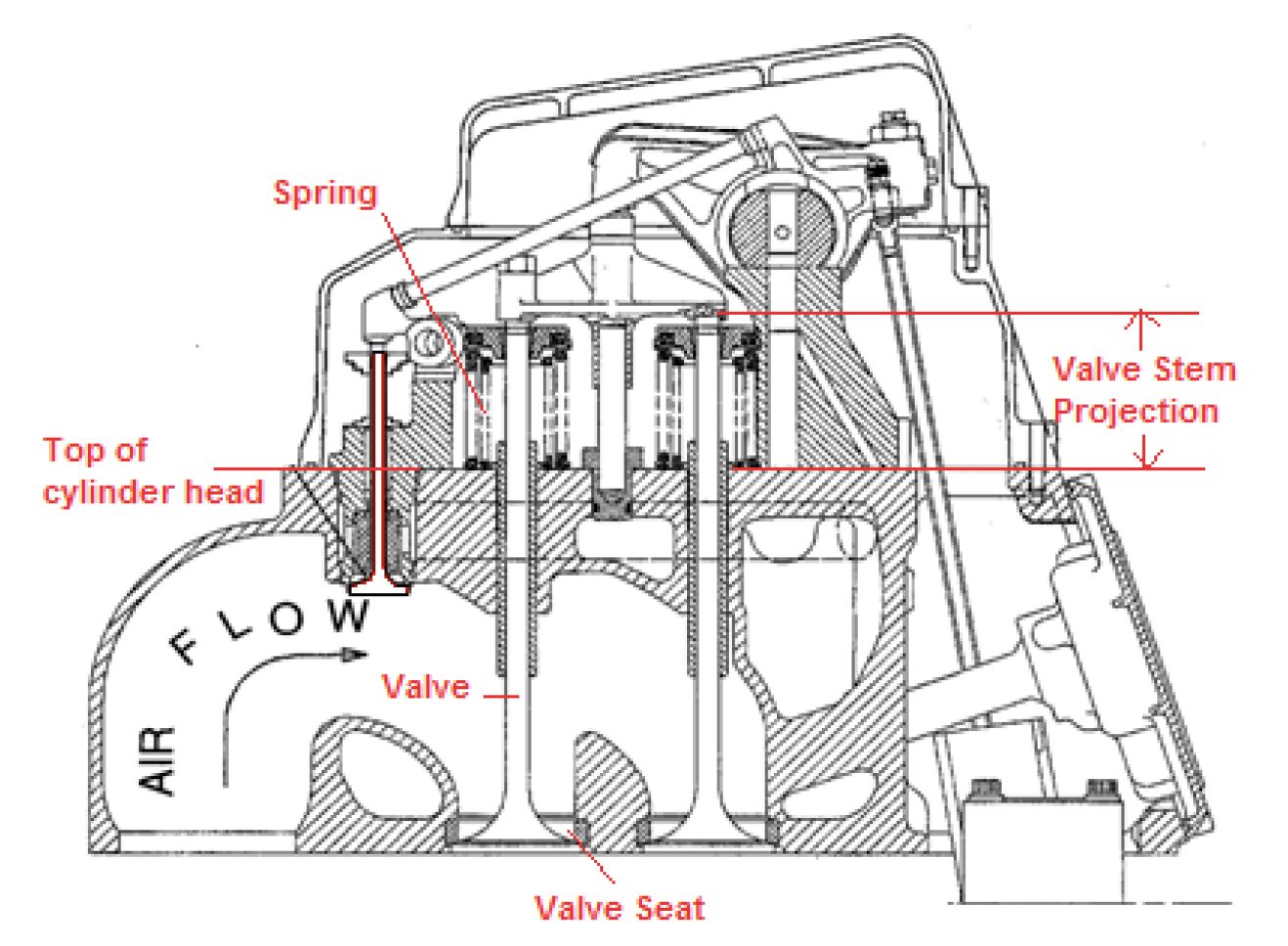

Engine valves are designed to recede into the valve seat with everyday wear, and valve lash gaps need to be adjusted regularly to maintain an effective combustion seal in the cylinders. The rate of recession varies with operating conditions, fuel quality and other factors. Measurement of valve stem projection is essential to trend analysis.

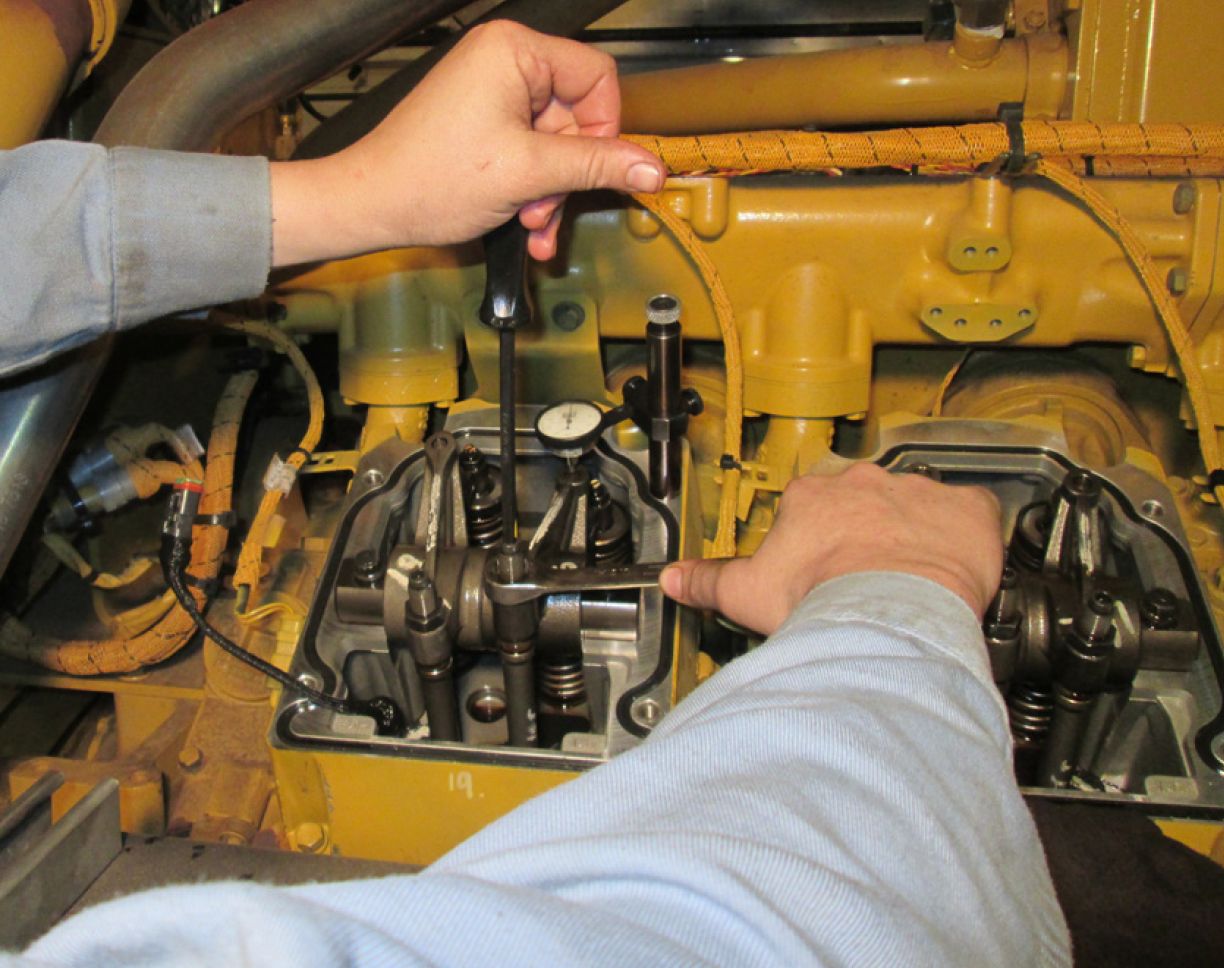

Valve stem projection indicates the amount of wear that has taken place between the valve faces and valve inserts. The initial valve stem projection should be measured after the first 1,000 hours on a new cylinder head – the normal “beat-in” period in which the valve becomes seated on the insert. This establishes a wear baseline. After that, measurements should be taken at spark plug changes.

Besides trending wear, valve stem projection measurement can indicate impending engine trouble. Valve stem projection normally will increase as the valve wears into the valve seat over time. A loss of stem projection signals a buildup on the valve face that could hold the valve open and cause valve burning. For example, prolonged light-load operation increases oil consumption and may lead to valve coking.

Buildup on the valve face also changes valve lash and therefore valve timing, in turn affecting airflow and the air/fuel ratio in the cylinder. An incorrect valve open/close sequence may cause loss of compression, a richer fuel mixture leading to detonation, or excessive inert exhaust gases in the cylinder at ignition, reducing power output.

Engine manufacturers set specifications for maximum allowable valve stem projection. Measurements must be taken consistently and accurately. Ideally, the same person should always measure projection on a given engine, using the same tool and method. Projection is typically measured in millimeters, and different measuring devices and techniques can meaningfully skew the trend data.

COOLING SYSTEM

Coolant is an essential fluid that serves multiple purposes.

Its most obvious benefit is freeze protection, but it also elevates the boiling point of cooling water, enhancing cooling efficiency. Just as important, it contains additives that prevent mineral scale formation in coolant channels, lubricate water pump seals, inhibit rust and prevent cylinder liner cavitation erosion.

Select a coolant type recommended by the engine manufacturer and mix it with deionized water in the appropriate proportion for the site (50-50 is typical for colder climates, but warmer climates year-round may call for other mixes). A simpler approach is to use a premixed coolant product. In any case, too weak or too strong a coolant mix for your location will hurt engine performance and life. Even engines in equatorial areas where antifreeze is not used require coolant conditioners to maintain the coolant for optimal performance.

Like oil, coolant should be analyzed regularly, at least on a yearly basis. An effective analysis program can help you verify proper coolant chemistry, monitor cooling system condition and correct coolant or cooling system problems before failures happen. Analysis can detect symptoms of trouble such as improper pH, unacceptable water hardness, presence of precipitates, low or high glycol level, oil in the coolant, and elevated lead, copper, and aluminum levels.

Cooling system pressure is also important. A leaking pressure-control cap will lower the coolant boiling point, allowing water to boil off and escape. In addition, steam flashing off the cylinder heads can limit cooling capacity and lead to premature component wear.

All maintenance procedures that apply to ordinary cooling systems also apply to combined heat and power installations – the essential function of heat recovery remains the cooling of the engine.

OTHER TRENDS

Other engine trends bear watching for their potential impact on performance and for what they indicate about the engine’s status.

Engine load.

Heavy-duty industrial gas engines are designed to operate at or near full rated load for extended periods. Owner’s manuals generally specify that engines that are run at 60 percent load or less for a specified period must be restored to full load to burn off oil and deposits. Engine-generators that regularly operate at lighter loads use significantly more fuel per kilowatt-hour than they would at full load, and will be subject to higher maintenance costs per kilowatt-hour.

Ambient conditions.

Hot weather accelerates component wear and the breakdown of oil and coolant. Hot ambient temperatures make the air less dense and may also require derating the power of the engine. The same is true of operating at high altitude.

Inlet and exhaust manifold pressure and temperature.

Normal trending should establish the expected pressure and temperature values; any deviation in one or multiple cylinders is grounds for investigation. To cite just one example, increased exhaust manifold temperature and pressure could indicate a plugged or malfunctioning jacket water aftercooler, hindering heat rejection. Keep in mind that trending may be influenced by ambient conditions. An extremely hot ambient temperature, for example, may elevate exhaust manifold temperatures.

Oil temperature and pressure.

Here again, deviations from normal measured values merit investigation.

ENGINE OVERHAULS

Trending can help in tailoring overhaul intervals – top-end, in-frame and major overhauls – to the application. Typical intervals for many engines are in the area of 20,000 hours for a top-end, 40,000 for an in-frame and 80,000 for a major, but those intervals can be extended with clean fuel, proper operation and sound maintenance.

Top-end overhaul

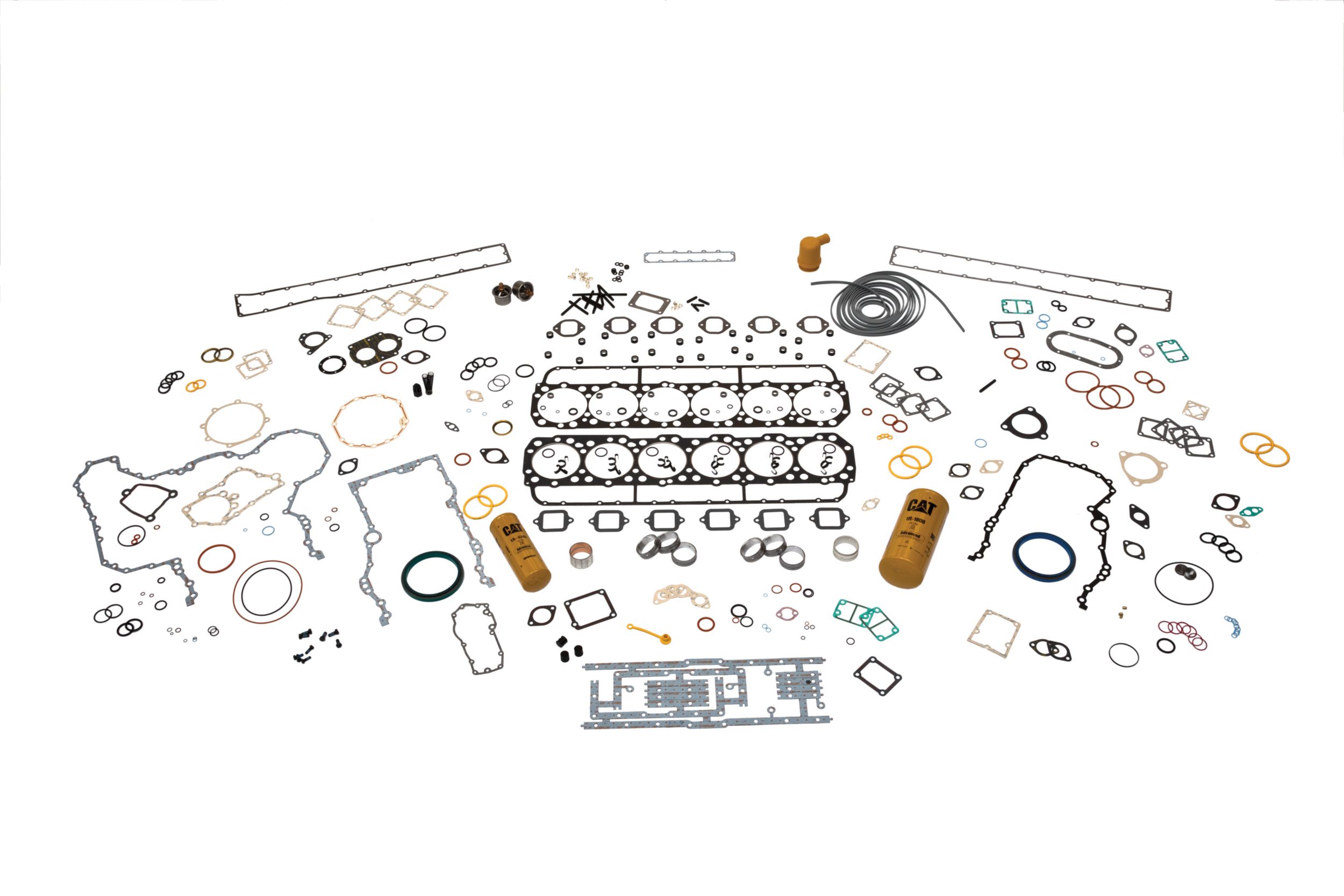

Top-end overhauls replace the cylinder head assemblies or rebuild them with new valves, seats, guides, springs, rotators, keepers and other components. Spark plugs are replaced and oil changed at the same time.

Key trend indicators of time for a top-end overhaul include valve stem projection, oil volume from the blowby recovery system and oil consumption – generally in that order of importance. Engine manufacturers specify maximum allowable growth in valve stem projection. One valve out of specification (sometimes called a “flyer”) is not necessarily grounds for a top-end overhaul – it may be an aberration caused by one softer valve or insert. However, if two or more valves exceed the specification, a top-end overhaul is indicated. With good planning, a top-end overhaul can be completed in 24 to 36 service hours.

For top-end overhauls, remanufactured cylinder heads can be a cost-effective alternative to new components. In this arrangement, the engine manufacturer or a dealer supplies heads rebuilt with a combination of new and/or remanufactured parts that meet the original equipment specifications and carry the same warranty as new. The engine owner then receives credit for the replaced heads and components.

While some manufacturers claim their engines need no top-end overhauls, all cylinder heads have moving parts that wear. Valve springs lift the valves up and down, valve rotators spin the valves about three degrees per stroke to keep deposits from forming on the valve seat, combustion heat works on the molecular chemistry of the exhaust valves and valve seats, and the metal itself wears from repeated contact. Claims of no need for top-end overhauls are generally based on replacement of individual cylinder heads at the time of wear-out or failure, and usually include extremely stringent or even unrealistic fuel quality specifications.

In-frame overhaul

An in-frame overhaul, as the name suggests, is a reconditioning of many of the engine’s internal systems in place, without removing the engine cylinder block from the generator or base rails. In-frame overhauls usually include many of the activities done at the top-end interval, including the replacement of the cylinder heads. An in-frame also typically includes replacing the pistons and connecting rod groups, cylinder liners, turbochargers, and main and connecting rod bearings.

The process can typically be completed in 36 to 60 service hours; however, ease of access to the engine and components and the skill levels of the mechanics involved will have a big impact on the amount of maintenance time actually required. With good planning, the process can be completed in 24 to 36 service hours. Indicators for an in-frame overhaul include oil consumption commonly caused by glazing of cylinder liners (easily identified by bore-scoping) and the elevated levels of wear metals (aluminum, copper, chromium, iron) in the oil, as detected through oil analysis.

Major overhaul

A major overhaul is essentially a complete rebuild that restores the engine to like-new condition. It replaces the same components as for an in-frame overhaul but also includes a rebuild of the front gear train (bearing replacement, gear inspection and replacement if worn), a change-out of the damper pulley, camshaft bearing replacement, a line bore inspection on the engine block (making sure that the crank and cam bores are still parallel to each other), and possibly more, including camshaft and crankshaft reconditioning.

Unlike the in-frame overhaul, a major overhaul requires uncoupling of the engine from the generator, removal from its building or housing, and transport to the controlled environment of an overhaul shop. The process can take 200 to 250 service hours for a typical 170 mm bore, 16-cylinder engine or longer if there are more cylinders or if abnormal wear exists. Indicators of time for a major overhaul include a 300 percent increase in oil consumption, or a 200 percent increase in oil volume to the blowby recirculation system, as measured from a baseline set at the 1,000-hour mark. A major change in exhaust emissions also may signal time for an overhaul, although that alone can indicate merely a need to adjust the engine emissions system or the control strategy.

Where possible, it is prudent to schedule overhauls of any kind around other expected outages. For example, if the gas utility will be shutting down the pipeline for maintenance about 2,000 hours before the time of an in-frame overhaul, it may make economic sense to complete the overhaul then, instead of restarting and then shutting down again a few months later.

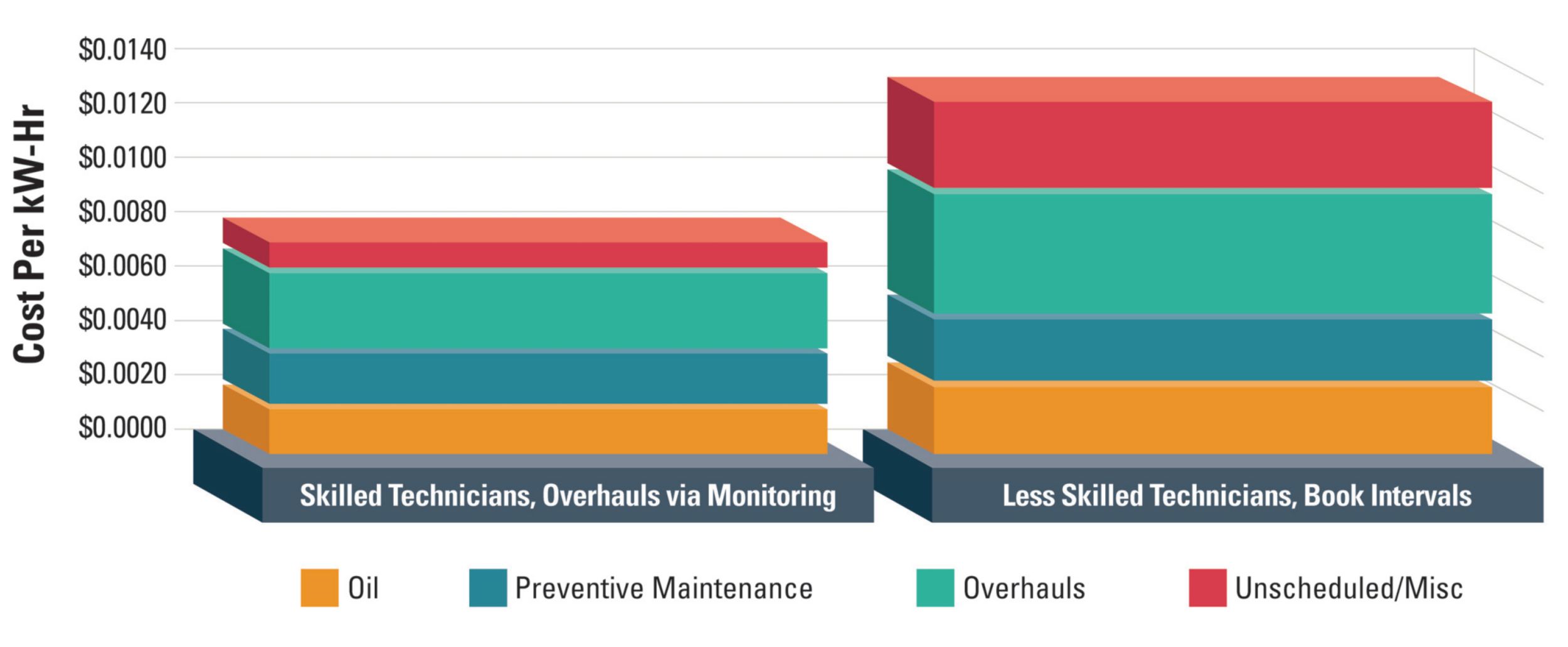

COUNTING THE COSTS

The success of a power generation project using natural-gas-fueled engine-generators comes down to the cost of electricity per kilowatt-hour. Profit margins can be slim – tenths of a cent in cost per kilowatt-hour can mean huge dollars over a project’s life. Typical capital costs for facilities and equipment vary widely, but are commonly in the 3 to 3.5 cents per kilowatt-hour range and are largely inflexible. Maintenance costs, on the other hand, are mostly under the owner’s control.

How much does good maintenance cost? Every application and service regimen is different, but a conservative rule of thumb for "all in" maintenance costs on a project using natural gas generator sets is between 0.7 and 1.3 cent per kilowatt-hour.

A poor facility design that makes equipment access difficult, a poor-quality pipeline fuel, local parts duties and import fees and other factors can drive that cost up.

How much does poor maintenance cost? There is essentially no upper limit. Engine failures, premature overhauls caused by rapid component wear, long spells of unplanned downtime – all these together can amount to many thousands and, in the case of large projects, even millions of dollars in hard expenses and lost revenue, significantly increasing the cost per kilowatt-hour.

Good maintenance is not difficult. It requires knowledge of trending methods, effective scheduling, well-trained people, quality replacement components and consumables, and access to technical support from your engine manufacturer. Trend-based maintenance will help keep productive hours up and costs down for the full duration of a power generation project.

About the Authors

Brian Snyder (Snyder_Brian_J@cat.com) is customer service manager with the Electric Power Gas Group of Caterpillar Inc., based in Mossville, Ill. Michael A. Devine (Devine_Michael_A@cat.com) is gas product/marketing manager with the Electric Power Gas Group of Caterpillar Inc., based in Lafayette, Ind.

SIDEBAR

The "B Life" Concept: Comparing Apples to Apples

With engines as with any industrial product, manufacturers make claims about reliability and durability: how long something will last without failing. To evaluate these claims – to compare “apples to apples” – it helps to have some objective measure.

One such measure is B life, a scale from zero to 100 that refers to the percentage of items that will survive to a given service life. For example, engine components are often designed on the basis of a B10 life. This is the age (in operating hours) at which 10 percent of the components will need to be serviced or replaced, and 90 percent of the components will still be in service.

The design of machinery, such as engines, always includes a compromise between durability and cost. To illustrate, in space exploration or airline travel, critical components are manufactured to a B life approaching zero – nearly 100 percent will survive to the designed life. This is extremely expensive, but necessary because failures are not acceptable and often mean that people die.

On the other hand, in industrial engines, component failures are undesirable and costly, but are usually not life-threatening. If built to a near-zero B life, engines would be so expensive that few users could afford to buy them.

Now, suppose that one engine manufacturer promotes a top-end overhaul interval of 20,000 hours, and a competitor with a similar engine promotes a top-end overhaul at 30,000 hours. Both claims may be true – but based on different B life standards. That is, the claim of 30,000 hours may be based on B50: just half the components will survive to the advertised life.

So, in comparing reliability claims, it is legitimate and prudent to ask each manufacturer: On what B life is the claim based? In this way, B life enables buyers to tell whether apples are truly being compared to apples. In fact, the service intervals in some manufacturers’ operation and maintenance manuals are listed at B10, while others are listed at B50.

Service references

SEBU6400-05

SEBU8554-03

SEBU7681-17