-

personclear

personclear

- place Find Dealer

-

Sign InAccount

One Account. All of Cat.

If you already have an existing account with another Cat App, you can use the same account to sign in here.

-

Explore Products

Browse all products on Cat.com

https://wwwqa.aws.cat.com

-

Buy Online

Shop products & more from our family of online store

https://qa3shop.cat.com/ShopLandingPageView

-

Find Used Products

Shop for certified used products

https://catused.com/

-

Rent Products

Find rentals at your nearest dealer

https://wwwqa.aws.catrentalstore.com

-

Manage My Equipment

Manage your fleet on VisionLink

https://vl.cat.com/visionlink?ui_locales=en-US

-

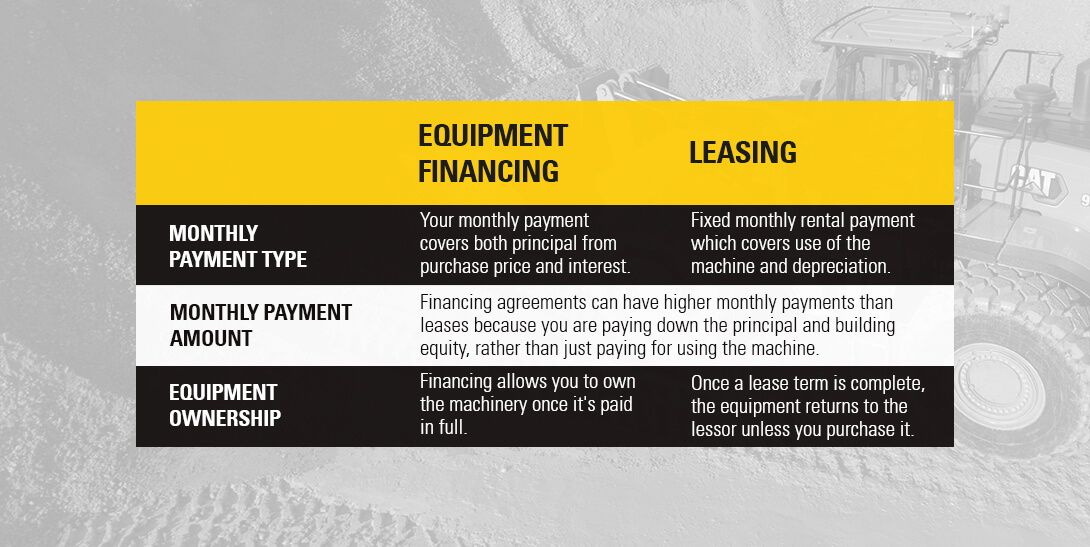

View Finance Solutions

Explore financing options on Cat Financial

https://www.cat.com/en_US/support/financing-protection.html

CAT Application

One Account. All of Cat.

If you already have an existing account with another Cat App, you can use the same account to sign in here.

Find Dealer

Find Dealer

Need help finding a Cat dealer near you? Our dealer locator provides the most up-to-date information on Cat dealers close to you. Simply enter your address and select the type of equipment you're looking for. Or, if you already know the name of the dealer you're searching for, you can type in the dealer's name for a list of locations.

Your dealer has been set close

Would you like to set this dealer to your account as well?Your dealer has been set close

Would you like to set this dealer to your account as well?Your dealer has been set close

Would you like to set this dealer to your account as well?You're Leaving Cat.com

Note that by entering data in this application for purposes of obtaining driving directions, you are providing such data directly to Google LLC and/or its affiliates. By clicking "I Agree" or by using the Google Maps functionality to obtain driving directions, you acknowledge and agree that use of Google Maps is subject to the then-current Google Maps/Google Earth Additional Terms of Service at https://developers.google.com/maps/terms-20180207#section_9_3 and Google Privacy Policy at https://policies.google.com/privacy

You're Leaving Cat.com

Note that by entering data in this application for purposes of obtaining driving directions, you are providing such data directly to Google LLC and/or its affiliates. By clicking "I Agree" or by using the Google Maps functionality to obtain driving directions, you acknowledge and agree that use of Google Maps is subject to the then-current Google Maps/Google Earth Additional Terms of Service at https://developers.google.com/maps/terms-20180207#section_9_3 and Google Privacy Policy at https://policies.google.com/privacy

You're Leaving Cat.com

Note that by entering data in this application for purposes of obtaining driving directions, you are providing such data directly to Google LLC and/or its affiliates. By clicking "I Agree" or by using the Google Maps functionality to obtain driving directions, you acknowledge and agree that use of Google Maps is subject to the then-current Google Maps/Google Earth Additional Terms of Service at https://developers.google.com/maps/terms-20180207#section_9_3 and Google Privacy Policy at https://policies.google.com/privacy