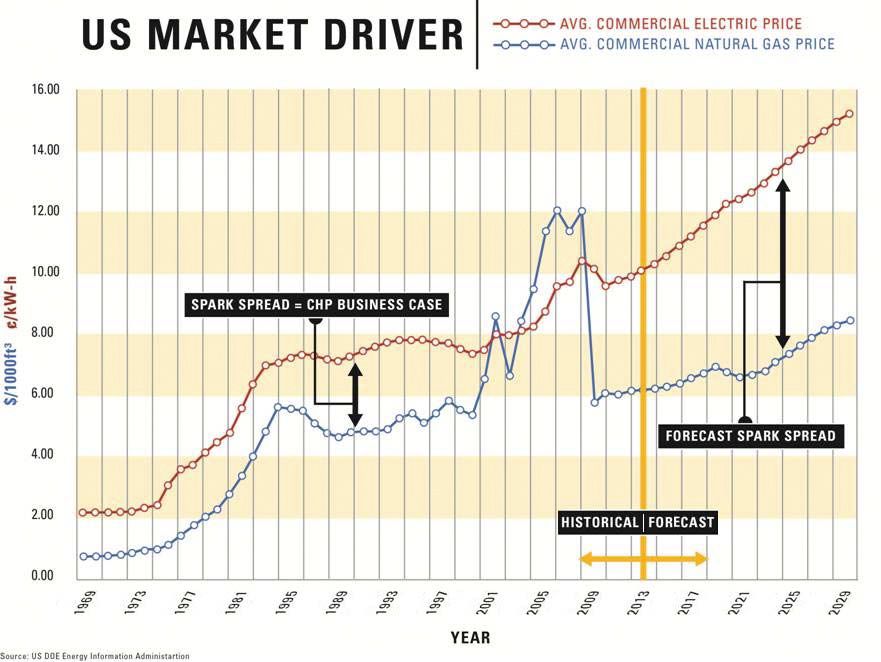

The main reason for the favorable gas price position is that shale gas production through hydraulic fracturing (fracking) has dramatically increased the supply. Average wholesale natural gas prices fell 31 percent in 2012,2 and recent prices generally have ranged from $3 to $5/MMBtu – levels not seen since the early 1990s.

Meanwhile, utility electricity prices have risen steadily and are projected to keep rising because of coal plant retirements, infrastructure improvements for transmission and distribution, and a host of other factors. Demand for electricity continues to grow faster than the supply (though more slowly now than before the 2008 recession). As a result, utilities face significant costs to build new power plants and expand their transmission infrastructure – often against political resistance, nationally and locally. Here, engines and turbines can fill valuable roles.

2 Today in Energy, 2012 Brief: Average wholesale natural gas prices fell 31% in 2012, U.S. Energy Information Administration

Fulfilling demand

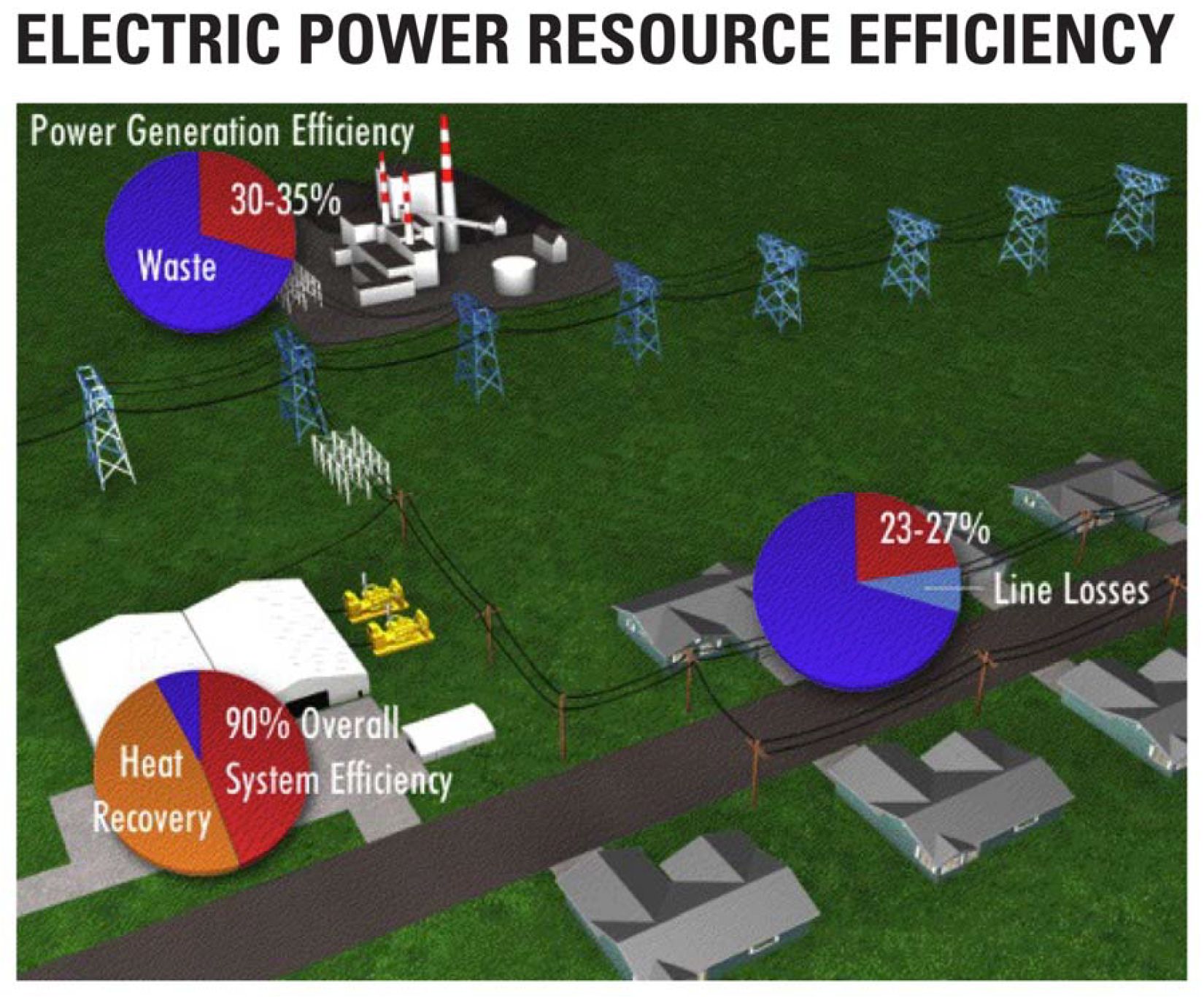

As distributed power resources, engines and turbines are inherently more efficient than large, centralized power plants. For example, a coal-fired utility power plant is typically 30 to 35 percent efficient, and line losses in long-distance transmission and distribution mean net efficiency at the point of use may be as low as 23 to 27 percent. By comparison, a gas engine or turbine installation will deliver 35 to 45 percent electrical efficiency (based on fuel low heating value), and line losses are minimal if the power is used nearby. The addition of heat recovery can boost total resource efficiency to 90 percent, or even higher. See Figure 2.

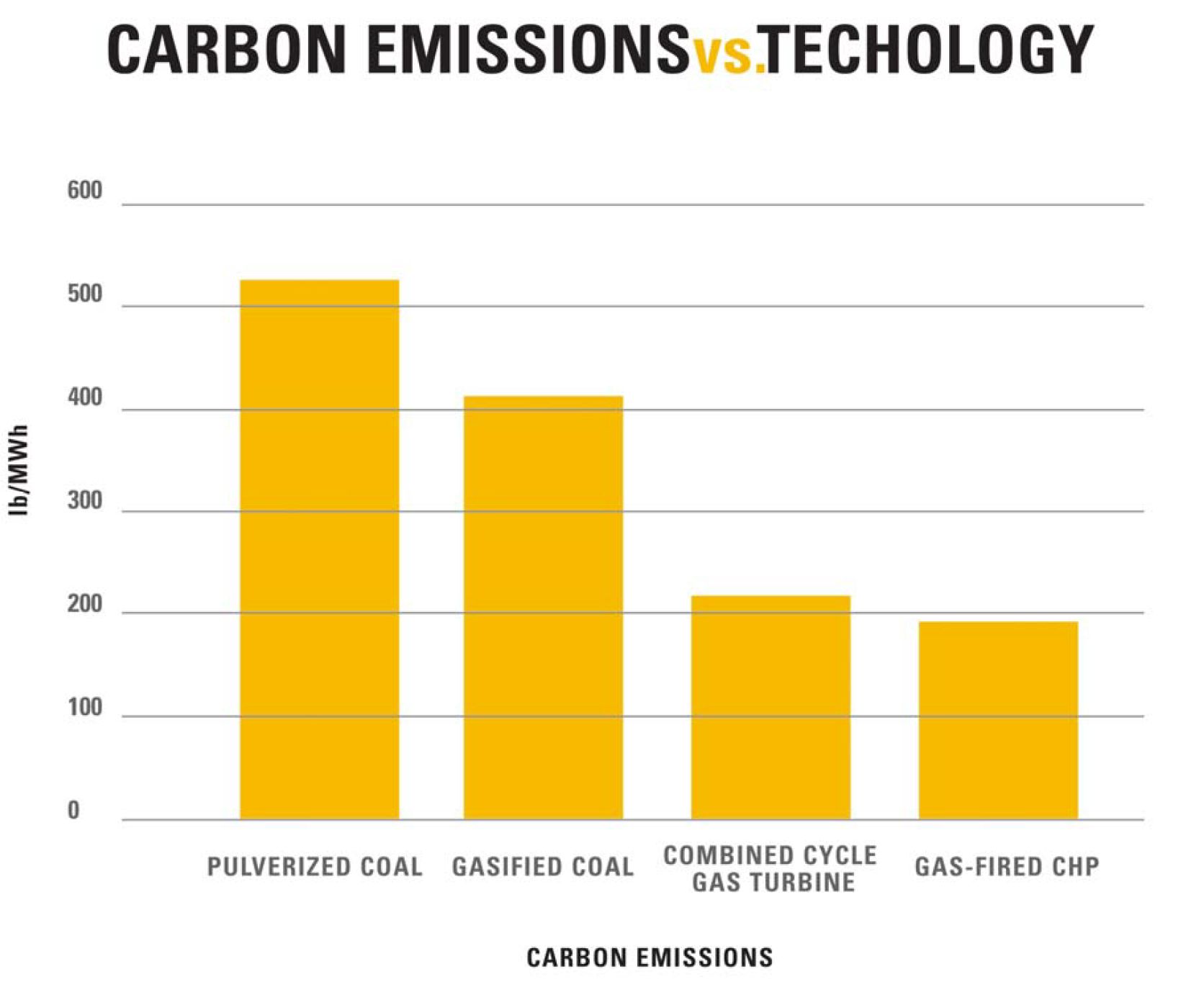

Public policy and the push for sustainability are also driving adoption of gaseous fuels: Turbines and gas engines produce lower carbon dioxide emissions than coal-fired sources (Figure 3)3.

3 U.S Energy Efficiency Administration

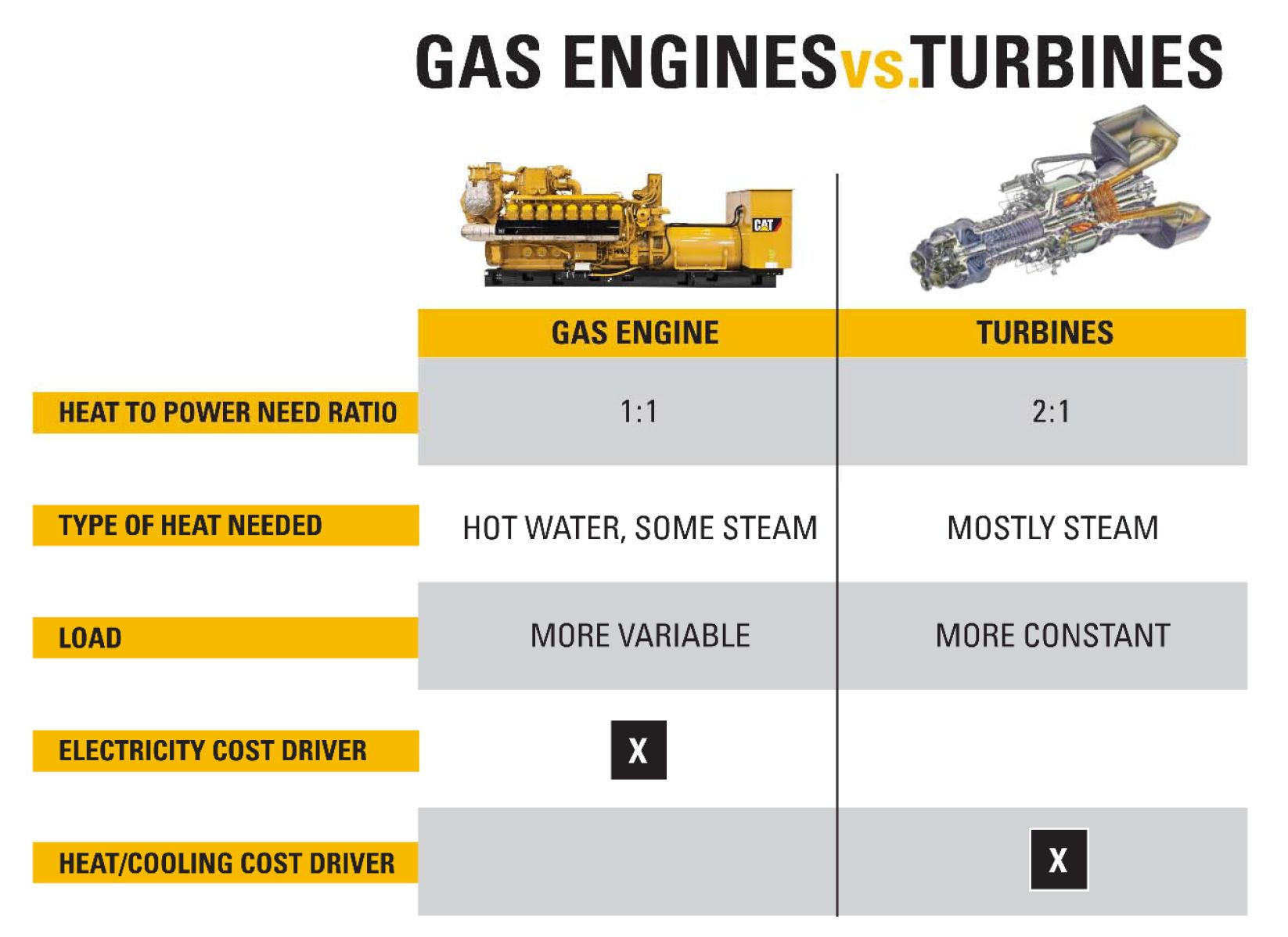

While engines and turbines share many attributes, they also can occupy distinct niches as demonstrated in Figure 4.

As distributed generation and CHP resources, both technologies are quick to install, and up-front costs per kW are relatively low. They emit low levels of NOx and other regulated pollutants. They are highly reliable, often achieving up to 98 percent uptime when properly maintained and operated.

Both have excellent track records in continuous-duty, high-load operation. They operate efficiently on a variety of fuels. Systems are forgiving in accommodating available space – multiple and flexible configurations are possible. See example in Figure 5 and Figure 6.

Turbine attributes

Turbines are well suited for full-load operation for extended annual hours. The favorable economics of CHP can make them attractive for continuous, base-load duty. That is especially true where local utility power is unreliable or of poor quality. Turbines’ greatest attribute in CHP service is their high heat-to-power ratio. They produce a large volume of exhaust at temperatures of roughly 900° F (490° C), versus 750° F (400° C) for lean-burn engines. As a result, they produce high-quality, high-pressure steam, well in excess of 100 psi (690 kPa), suited for many industrial processes. Combustion turbines also have high excess oxygen in the exhaust, enabling significant variations in thermal output.

Turbines are also lightweight and have a compact footprint, producing three to four times the power in the same space as reciprocating engines of similar capacity. Their design is extremely simple – there is no liquid cooling system to maintain, no lubricating oil to change, no spark plugs to replace, and no complex overhauls to perform (only combustor replacement after about 60,000 hours of duty).

Emissions are extremely low, especially with the latest advances, such as lean-premixed combustion technology. Turbines are ideally suited for loads of 5 MW and considerably larger. They can operate on low-energy fuels and perform extremely well with high-Btu fuels, such as propane.

Engine attributes

Today’s advanced lean-burn reciprocating engines generally are more fuel-efficient than turbines in pure electric power applications. They have lower initial cost per kW in smaller projects (generally less than 10 MW) and are more tolerant of high altitude and higher ambient temperatures. They operate on low-pressure fuel – 1.5 to 5 psi (10 to 35 kPa) – eliminating the costs to install and maintain a fuel compression system.

Besides burning pipeline natural gas, engines readily accept many of the same lowenergy fuels that turbines can use, such as ag biogas, wastewater treatment plant digester gas and landfill gas, as well as specialized fuels like coke gas and coal mine methane. Special “hardened” reciprocating engine versions are available that can accept certain levels of low-energy-fuel impurities like hydrogen sulfide (H2S) or halides without requiring extensive fuel treatment, again saving on initial and lifetime costs.

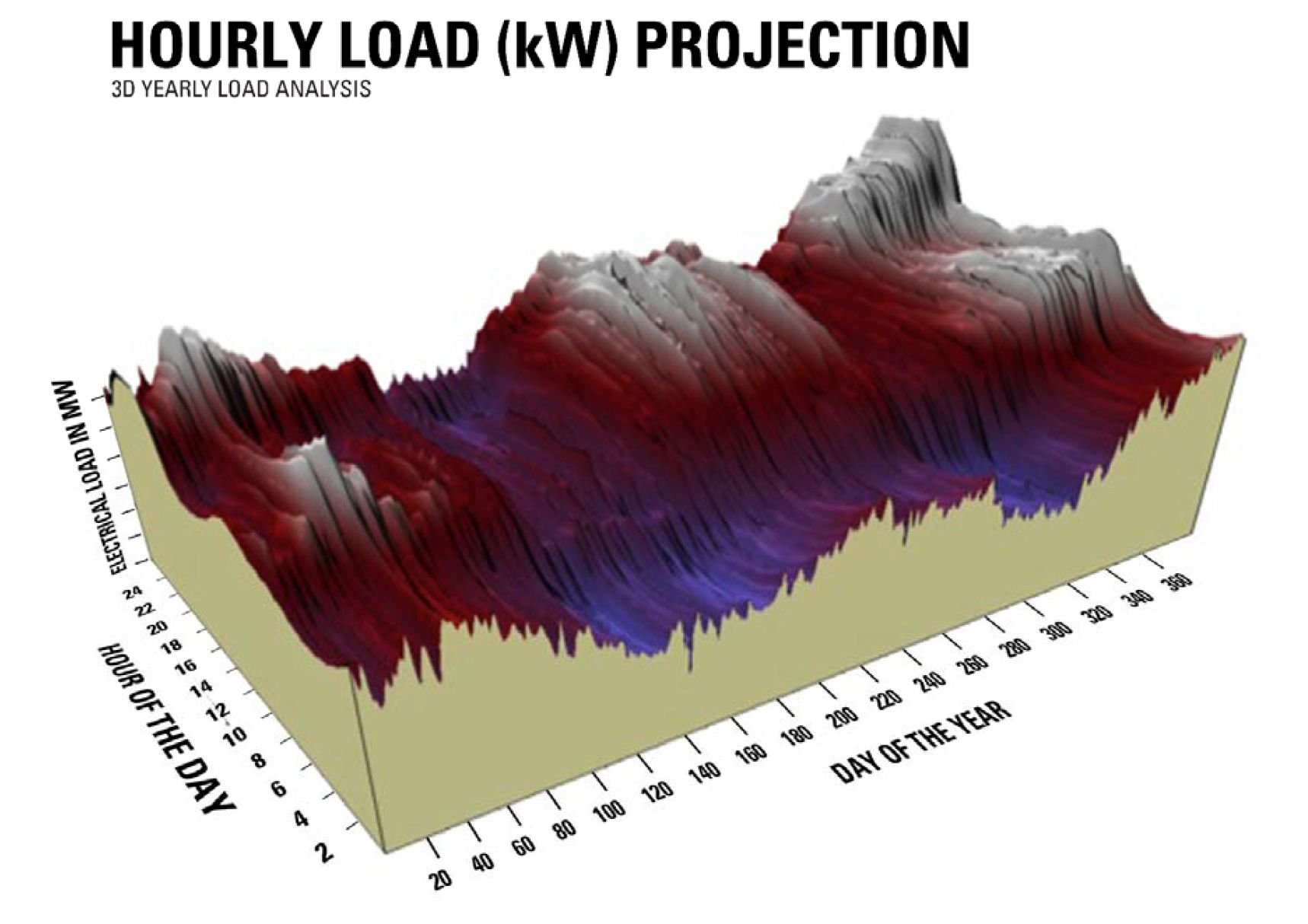

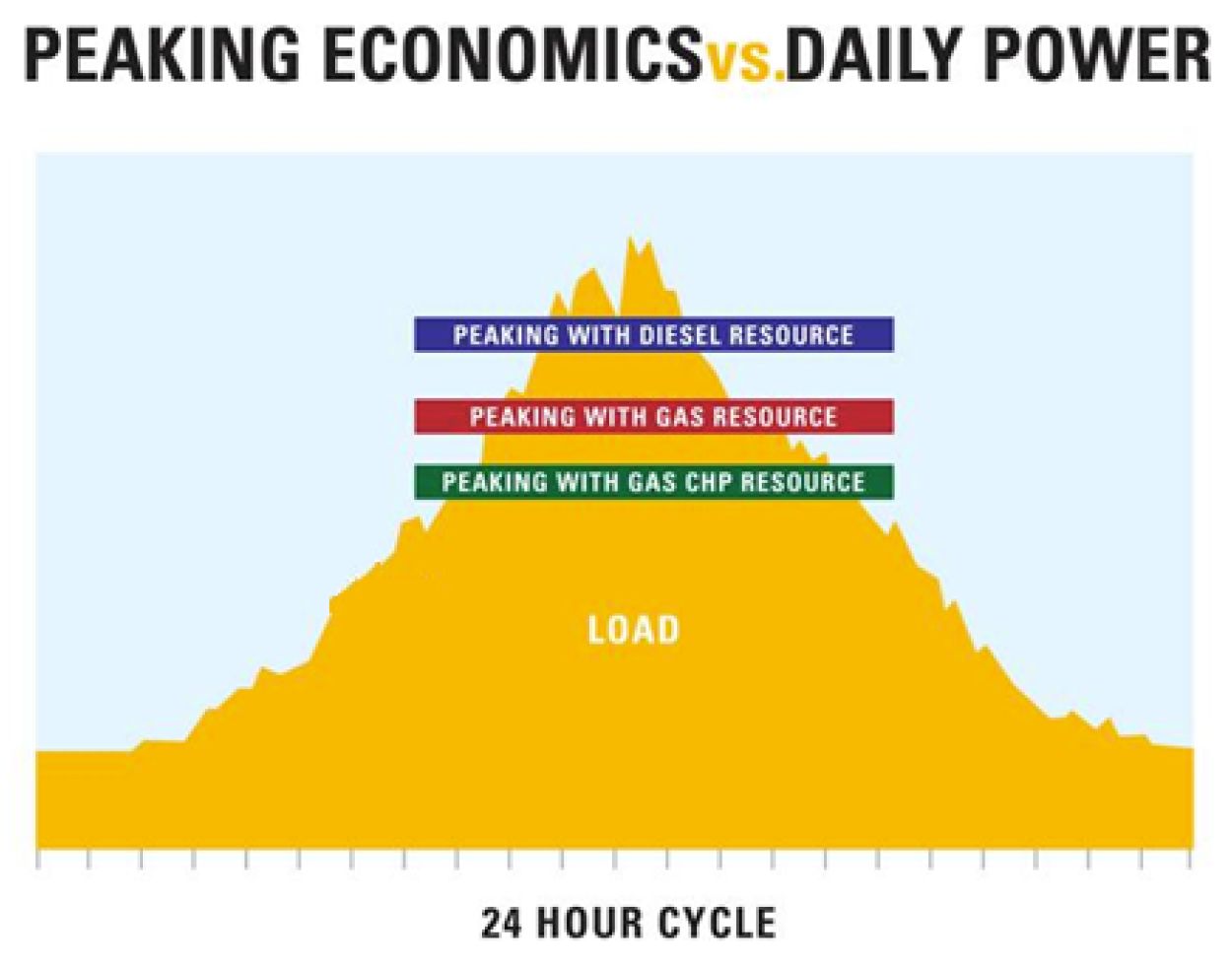

In cogeneration service, engines have multiple recoverable heat sources: Exhaust, jacket water, aftercooler and oil cooler. They can produce heat in the forms of warm water, hot water, and low- to medium-pressure steam (from exhaust). Engines’ greatest point of differentiation is their ability to follow variable loads and to come online quickly – in most cases within 15 to 30 seconds. This makes them ideal for distributed generation in support of electric utility grids. Typically, utilities need more capacity not to fulfill low-cost base load but high-cost peak demands that may occur only during a few weeks or months per year and at certain times of day. See Figure 7.

This favors low-cost, fast-online resources located near the point of end use – a niche for which gas-fueled reciprocating engines are ideal. In fact, many utilities provide rate incentives for installation of exactly that kind of resource – placed at a utility substation or hosted by a large commercial or industrial user, running in parallel with the grid and helping fulfill utility peak demand.

Historically, diesel-fueled generators were used for this purpose, some operating as little as 100 to 500 hours per year to help utilities handle the highest seasonal peaks. More recently, with stricter air-quality regulations and rising diesel fuel prices, gas-fueled units have become better suited to such duty. Their lower operating costs per kWh enable them to operate economically for up to 3,000 hours per year, or more as needed and the existing electrical rate structure allows.

The extended hours of operation, in turn, help justify investment in equipment to recover heat from generator exhaust and fluids – heat that can serve a host of purposes: building space and water heating, air conditioning (by way of absorption chillers), desiccant dehumidification, and heat or cooling (or both) for a host of industrial processes. Heat recovery improves economics so that it becomes cost-effective to operate the systems for 4,000 annual hours – essentially half the year – or even more. See Figure 8.

These gas-fueled systems are all the more attractive when they can also function as backup where utility power is often interrupted. Rising peak demands increasingly challenge utilities to sustain power quality and reliability. Long-lasting outages caused by storms, floods or fires are not the most significant issue, since these tend to be rare. Of more concern are voltage fluctuations that can damage computers and other sensitive electronics, and multiple, short-duration outages that menace manufacturing processes. A reliable on-site generation system provides reliable protection against such events.

WHICH TECHNOLOGY WINS?

On many if not the majority of CHP projects, the choice between engines and turbines is clear, provided the economic analysis is done correctly. For example, if the application has low-pressure gas, calls for low-temperature heat recovery, is located at high altitude or involves variable loads, reciprocating engines are most likely the preferred choice. If the facility has a high and relatively constant electric load and calls for heat recovery as high-pressure steam, turbines would most likely be preferred.

In certain applications, hybrid engine-turbine systems can be beneficial. Consider a facility that has a variable load with peaks at 20 MW, a substantial heat load that needs high-quality steam, and other heat loads that use lower-quality heat. Such an application might be well served by a 10 MW turbine providing base load and steam, 5 MW of reciprocating engines running continuously and producing hot water, and an additional 5 MW of engines with no heat recovery, following the variable portion of the electric load.

MULTIPLE APPLICATIONS

Engines and turbines are used in CHP applications that include electric utilities, hospitals, universities, district heating, seawater desalting, food processing, textiles, petrochemical refining, chemical processing, pharmaceuticals, pulp and paper, and general manufacturing.

Heat recovery can be enhanced by supplemental firing with natural gas, increasing exhaust temperatures and heat output to produce steam at greater volumes and pressures. In addition, recovered heat can be used to produce cold water for space or process cooling by passing steam, hot water or exhaust through absorption chillers, which use heat instead of electricity as the energy source.

The efficiency of absorption chillers is measured by coefficient of performance (COP). Simple, relatively low-cost single-effect absorption chillers are activated at temperatures as low as 200° F (93° C); COP typically ranges from 0.7 to 0.9. More complex doubleeffect units, activated at 347° F (175° C), deliver higher COP (1.05 to 1.4), although at greater up-front cost.

Heat-recovery systems can be configured to deploy some heat for water and steam production and the balance to absorption chillers or steam-turbine-driven chillers – a concept called tri-generation. Alternatively, systems can produce space heat in winter and air conditioning in summer.

ASSESSING ECONOMICS

Every cogeneration project comes down to a question of economics: Will savings on energy costs, revenue from electricity sales to the grid, or both, provide adequate return on the investment in equipment? In general, the outlook is best in markets where:

- The utility electricity cost is relatively high

- The fuel price is relatively low

- The system will operate with a high electrical and heat load factor

- Electric and thermal loads coincide during a typical day

- The site requires high reliability and power quality

- The cogeneration system can double as a standby power source

- Energy efficiency grants or rebates are available

- The local utility must meet Renewable Portfolio Standards or similar requirements to deploy renewable or green energy.

The availability of a low-cost “opportunity fuel” such as anaerobic digester or landfill gas, generally improves the economics.

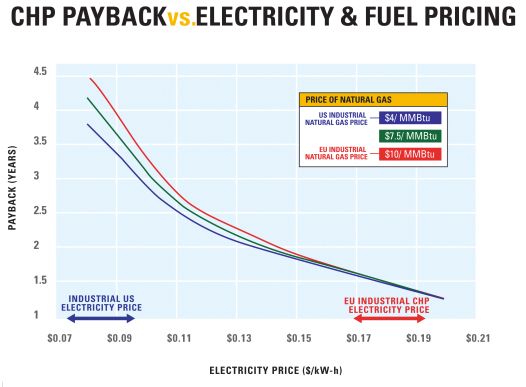

In reality, electricity price affects economic payback much more strongly than fuel price as depicted graphically in Figure 9.

For example, at any give fuel price, payback time is similar at a gas price of $4/MMBtu (the prevailing industrial rate in the U.S.), $10/MMBtu (reference European subsidized price), or at points in between. However, payback time increases as electricity prices fall.

Another critical factor in payback is equipment utilization, or load factor. In general, the lower the load factor, the longer the payback. At load factors of 80 percent or lower, payback time begins increasing rapidly since the asset is not being fully utilized. However, other consideration may override the importance of power factor – such as a critical need for power security or a need to protect a high-value process against downtime from loss of power.

Checking feasibility

It takes specialized expertise to evaluate CHP project economics. So, before investing in a full feasibility study, it makes sense first to check for fatal flaws – physical or cost barriers that would make a proposed project impractical. For example:

- Will it be technically difficult or prohibitively expensive to obtain an air-quality permit?

- Will it be difficult to secure a wastewater permit to discharge engine cooling water or exhaust condensate?

- Is available space on the site too small for the engine and heat-recovery equipment?

- Will the natural gas service need a costly upgrade to deliver the necessary fuel?

- Is the facility’s electric power infrastructure inadequate to distribute the generated power?

- If project success calls for excess electric energy generated to be exported to the grid, do local utility policies preclude such sales?

- If exporting power to the local utility is possible, is the power purchase price available too low to allow for profitable operation?

If the answer to any of these questions is yes, then unless the projected economics are truly compelling for some reason, the cogeneration project may not be worth pursuing further. However, if there are no obvious show-stoppers, the next step is a high-level look at the economics. This involves estimating and stacking the component costs and savings (or revenues) per kWh to arrive at the net benefit. A local engine-generator dealer or turbines sales representative can be a good source of reasonable, experiencebased estimates. The major cost components are:

- Fuel – typically the largest item at 60 to 80 percent of project cost (significantly less if an “opportunity fuel” is available)

- Capital recovery – principal and interest (P&I) on the equipment investment

- Operations and maintenance (O&M)– staffing, components and supplies for daily operations, periodic service, and repairs.

From the total of these costs, the thermal credit is deducted – the economic value of the recoverable heat. This is typically done by looking at the cost per kilowatt-hour of replacing the existing thermal system with a higher-efficiency system. If the resulting total net cost per kilowatt-hour is significantly lower than the retail price of electricity, including demand charges, then the project probably merits further investigation through an engineering study.

Understanding electricity costs

In the final analysis, it is essential to understand the utility electricity cost structure in detail. This includes:

- The facility load profile and the amount of energy and demand used on- and off-peak

- Current on- and off-peak energy tariffs – and available alternatives (such as interruptible rates) that would be advantageous with a CHP system on site

- On-peak and off-peak demand charges, as well as standby charges, ratchet provisions, and any other penalties for non-availability

- Existing or pending cogeneration incentives (from the utility or government).

Ideally, a project should be developed in a cooperative relationship with the local utility. For example, a project that reduces the user’s overall energy costs while helping the utility limit peak demands on its grid provides a win-win – and may even benefit from utility incentives that enhance economic payback.

CHOOSING A PARTNER

Few organizations have the in-house expertise to plan and implement CHP projects with turbines or reciprocating engines. Equipment suppliers and consultants can provide vital support from project planning through design, financing, construction, operation and maintenance.

An appropriate project partner should have a deep understanding of CHP in general, knowledge of both reciprocating engine and gas turbine generating systems, and a track record for deploying both in profitable projects. Such a partner can help choose the best technology – or the best combination of technologies – to fit the site’s electric and heat requirements and the owner’s economic goals.

Fast service response time, prompt spare parts delivery, and efficient repair and overhaul services are essential – locally based service and technical support can help ensure that a project is properly operated and maintained so that unplanned downtime is prevented and revenue and savings optimized.

The ideal partner offers single-source support for every project phase, including turnkey ability to design, construct and operate the project. One attractive option is to enter a complete, multi-year maintenance and service contract with an equipment supplier. This ensures attentive parts, maintenance and repair service, often with a contractual uptime guarantee, at a fixed, predictable monthly or annual fee.

Financing is a critical component of any CHP project. Numerous options are available, up to and including construction and term debt financing for the entire project – power generation system, heat recovery equipment, electrical switchgear and controls, ancillary equipment, and buildings.

THE TIME IS RIGHT

Gaseous fuels are emerging as the preferred choice for electric power generation. Gas is more widely available today than ever, and steady improvement in the spark spread is causing users to explore the value of distributed generation and CHP with turbines and gas engines.

Both turbines and reciprocating engines have proven themselves to be valuable to users in power generation applications. Well accepted in the market place today worldwide, each technology has found favor with users looking for reliable power and thermal alternatives. All of this means strong opportunity for gas-fired CHP systems. The time is right for industrial and commercial facilities power users and producers to explore the economic possibilities of CHP with today’s gas engine and turbine technologies.

ABOUT THE AUTHORS

Michael A. Devine is Gas Product Marketing Manager with the Electric Power Division of Caterpillar Inc., based in Lafayette, Ind. He can be reached at Devine_Michael_A@cat.com.

Chris Lyons is the Power Generation Solutions Manager for Solar Turbines, a subsidiary of Caterpillar Inc. He can be reached at Lyons_Chris_D@solarturbines.com.