Steven J. Szymanski

Caterpillar Financial Services Asia Pte. Ltd.

International Sales Manager for Electric Power, Asia-Pacific

Michael A. Devine

Caterpillar, Electric Power Division

Gas Product Marketing Manager

John C.Y. Lee

Caterpillar Asia Pte. Ltd., Electric Power Division

Territory Manager for Asia-Pacific

October 2013

ABSTRACT

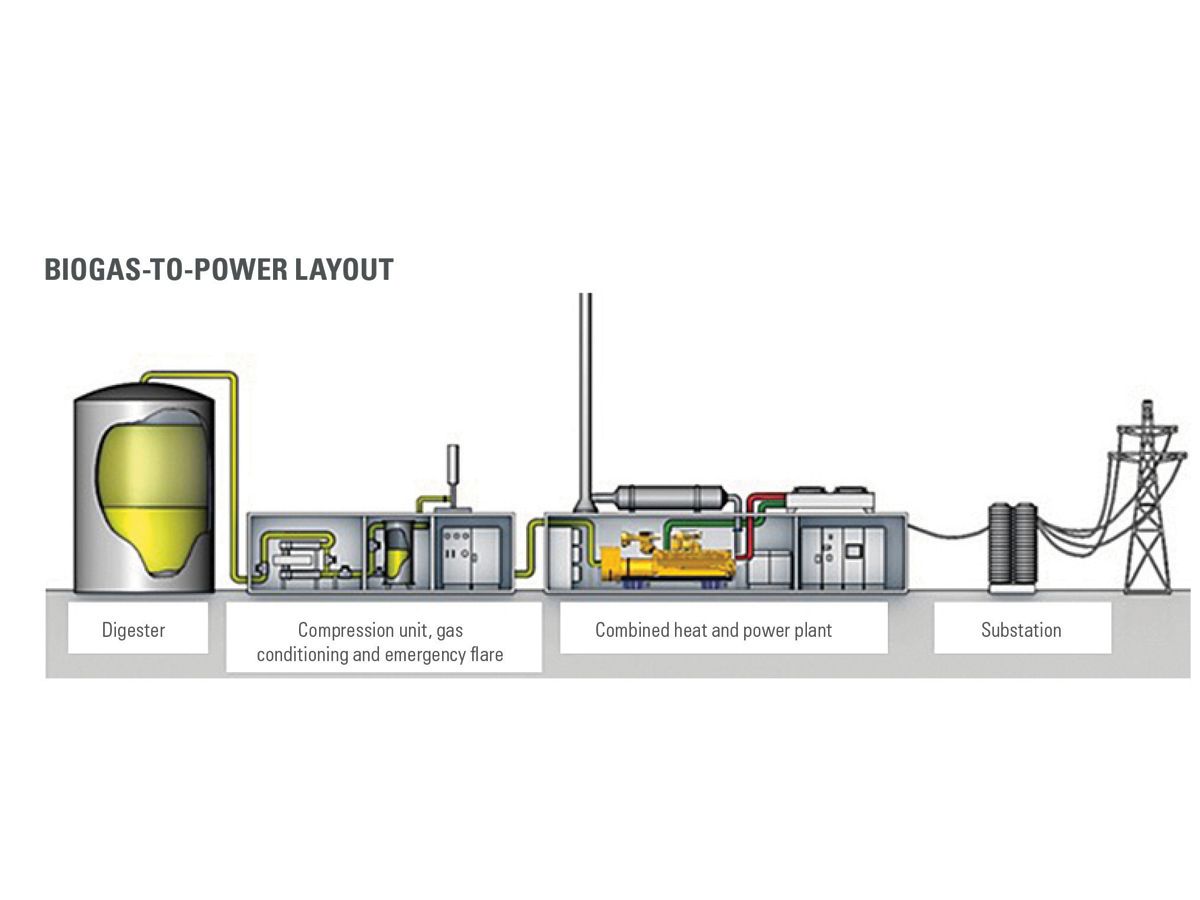

Many of the world’s regions stand on the threshold of substantial growth in power generation with renewable biogas fuels. Landfills, wastewater treatment plants, coal mines, food processing plants and many crop and livestock operations offer major potential as methane fuel.

Biogas-to-energy projects using reciprocating gas engine-generator sets can contribute sustainably produced electricity to the grid or for captive use, mitigating waste management concerns and destroying a potent greenhouse gas, while delivering strong economic returns. Prospects are excellent for generating profitable power with “free” fuels – while delivering social, economic and environmental benefits – so long as projects are properly planned and effectively managed.

introduction

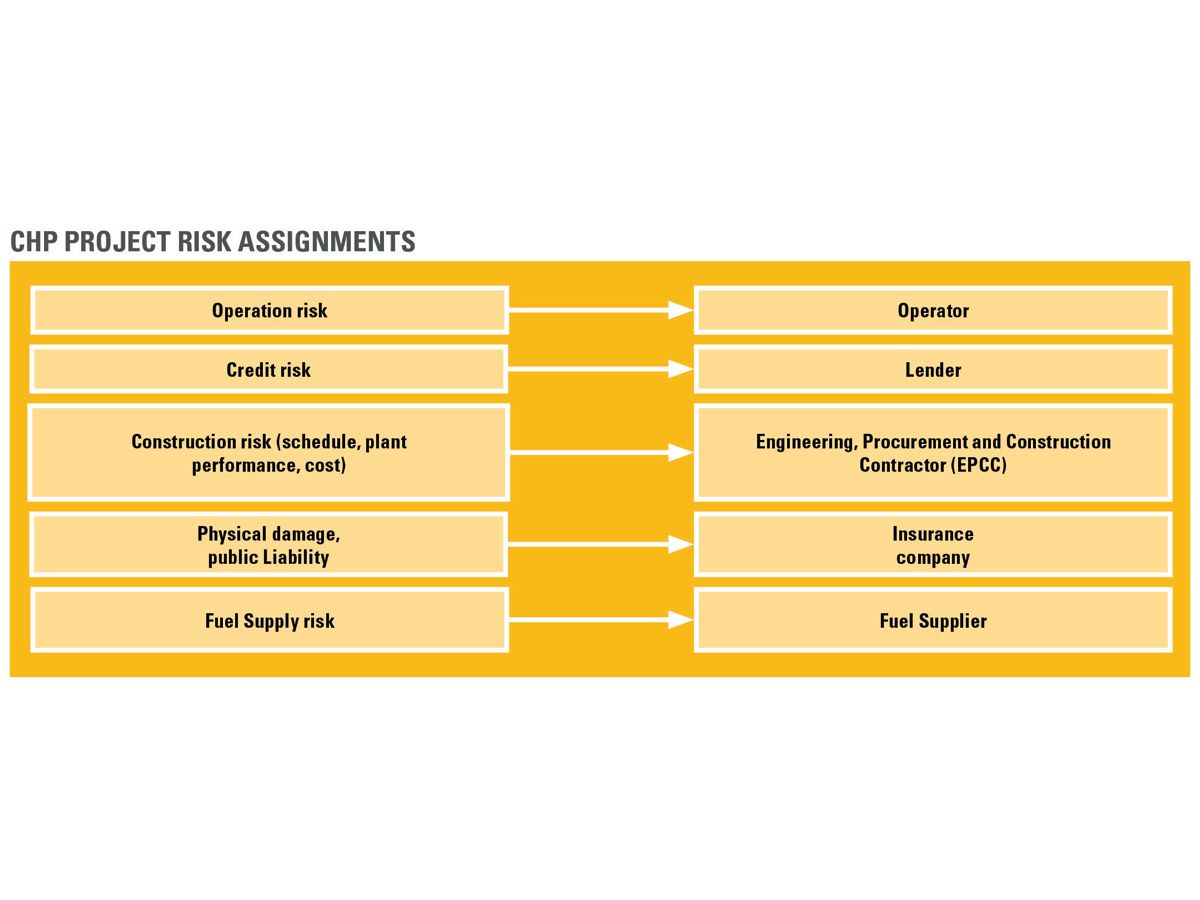

Like any generating facility, biogas-fueled power plants require proper capital investments and sound long-term operation and maintenance regimens. In addition, unforeseen conditions and events can negate the advantage of avoiding the cost of natural gas, diesel or other traditional fuels. All risks connected with a project must be recognized and each allocated to the party best equipped to manage it. For a typical biogas project, the critical risks include:

- Feedstock supply (fuel reliability and quality)

- Revenue (power sales tipping fees, digestate sales)

- Technology (equipment track record and performance/efficiency)

- Operations (uptime, ease and availability of operation and maintenance)

- Construction (schedule, plant performance, cost)

- Credit (financing and debt repayment)

- Insurance (physical damage and public liability)

- Inflation (for both revenue and expenses)

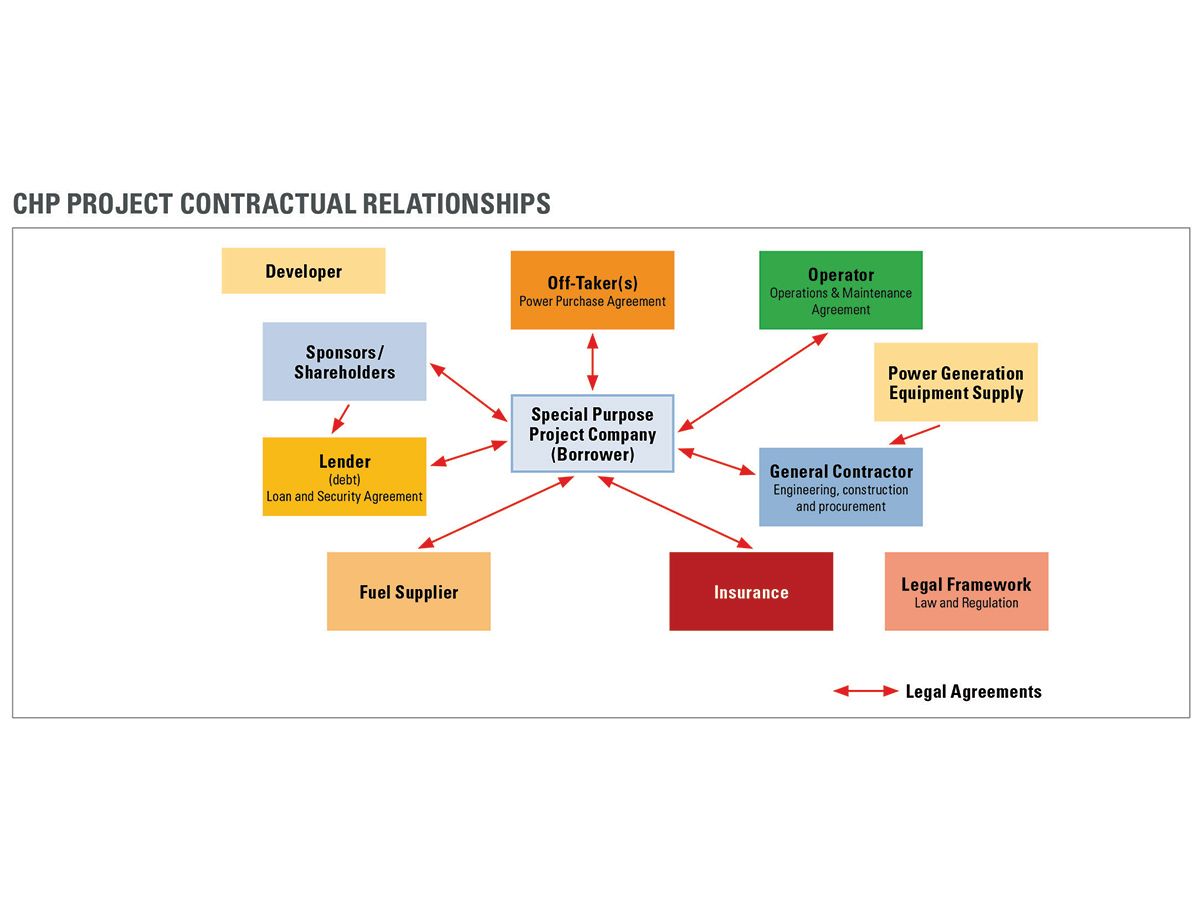

Risks are best managed through contracts. The project owner, lender, equipment supplier, contractors and other parties must assemble a functional, reliable solution that meets financial and performance objectives.

TAPPING THE POTENTIAL OF BIOGAS

Opportunities existing for biogas development depend on locally available fuel sources and on economic, social and political trends work. National, provincial and state governments may offer a variety of incentives – such as favorably structured feed-in-tariffs (FIT), tax holidays, partial invest-ment grants, duty-free capital equipment importation and value-added tax exemptions – to promote cleaner, renewable fuels and reductions in greenhouse gas emissions. Programs for rural electrification in some nations also encourage development of small-scale energy projects in outlying areas, where renewable energy opportunities may abound.

Meanwhile, many governments are tightening environmental regulations affecting liquid waste, solid waste and air pollution from

agribusiness and other industry sectors, and are strengthening enforcement. In addition, some industry organizations may prescribe incentives and penalties related to sustainable operations.

Sources of renewable fuels are numerous and include a wide range of vegetable wastes, food processing wastes, livestock manure,

wastewater treatment plant digesters, landfills, and coal mines. Fuel from each of these sources presents its own challenges in variable volume, variable heating value, and content of impurities that must be managed to ensure that the generating plant runs

efficiently and – even more important – without unplanned interruptions (see Addendum 1).

KNOWING THE RISKS

Fuel variability is just one issue facing biogas-to-energy projects. For one, the projects tend to be relatively small – generally 1 to 10 MW – yet may have “soft costs” (legal and development fees) similar to those of much larger projects. Energy and its environmental considerations typically fall outside the core competencies of the feedstock hosts, and equity capital may be in short supply despite project risks that demand higher levels of it. This and other factors make effective risk management essential.

Feedstock supply risk

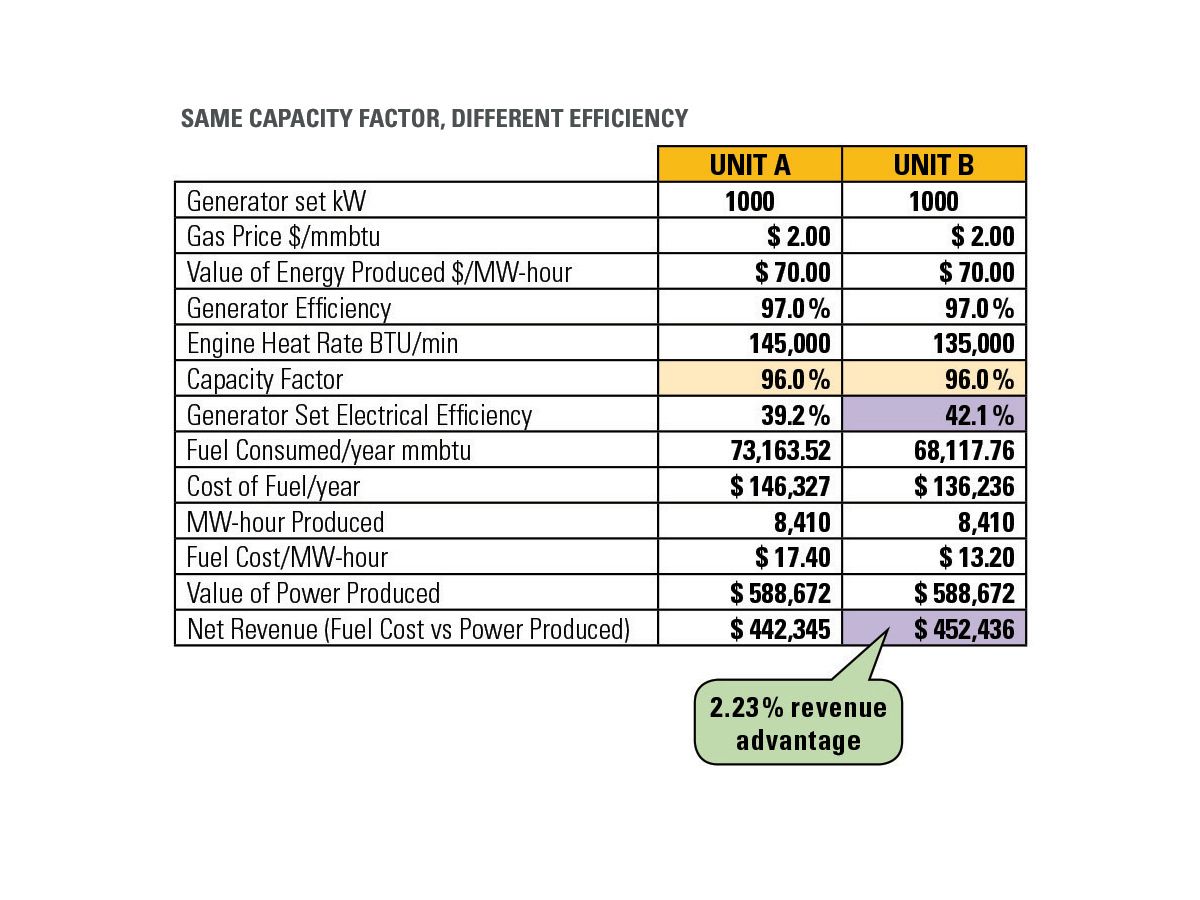

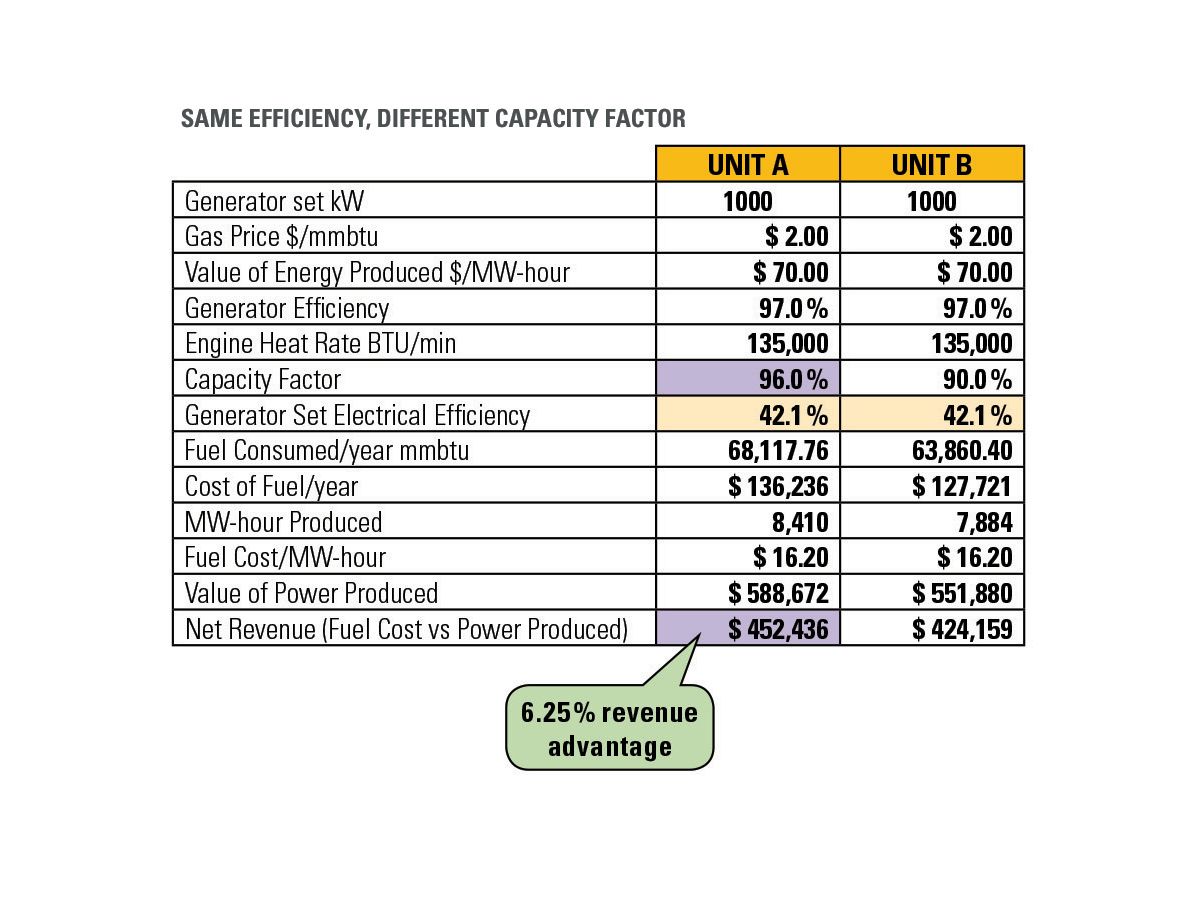

This is the number one risk factor that needs special attention. A biogas-to-energy project is unlikely to succeed if the long-term fuel supply is unpredictable or the fuel quality is uncertain. Project economics typically depend on a specific quantity of energy produced, and a resulting generator set capacity factor. A project based on, say, 95 percent capacity factor will surely fail if the fuel supply is frequently interrupted or curtailed, or if poor fuel quality keeps the equipment from operating at full rated output.

The project developer needs an ironclad, long-term contract with a feedstock supplier and should avoid situations that would allow the supplier to entertain competing offers from other feedstock users. A lender will typically require a feedstock supply agreement that extends two years beyond the loan repayment term.

Revenue risk

Similarly, a biogas-to-energy project needs a long-term power purchase agreement that binds the energy purchaser to a specific volume of kilowatt-hours (or energy) at an agreed-upon price for the duration of the term. Short-term purchase agreements or buy-as-needed contracts are generally not considered financeable unless a strong guarantor agrees to repay the loan regardless whether the electricity can be sold. A suitable contract typically includes a mandatory purchase (take-or-pay) obligation: The energy buyer cannot default on a purchase for any reason, including, for example, a malfunction of a transmission line or other facility within the buyer’s control that stops the flow of power. As in feedstock agreements, a power purchase agreement typically needs to extend two years beyond the loan repayment term.

Technology risk

Not all generating technologies are designed, manufactured, and serviced equally. It is incumbent on the project owner to select prime movers, generators and ancillary equipment with an eye toward a track record of performance in similar applications. While initial installed cost per kilowatt-hour matters to project success, proven reliability matters a great deal more. As part of due diligence, a project owner should ask all prospective equipment suppliers to offer references and data on successful projects of similar size and type operating on similar fuel. The technology provider should have both the ability and willingness to provide a performance guarantee for a term that is agreeable to the lender.

Operations risk

The best energy generating technology’s performance is only as good as the ongoing support it receives in the field. Improper maintenance or poor operating practices can lead to unplanned downtime that puts project financial results in jeopardy. Project owners should expect an equipment supplier to have built a substantial product support infrastructure in-country. This can include remote monitoring and diagnostics, on-demand technical support, fully qualified service technicians able to respond in less than

24 hours, and a local parts stocking and distribution network that ensures prompt delivery of genuine original-equipment replacements. Large expenses such as engine overhauls should be budgeted, and most project lenders will require a reserve account for major maintenance to be established and funded over time to cover these periodic costs. An attractive option is to enter a complete operations and maintenance agreement with the equipment supplier that covers all planned service at an annual fixed cost – this usually negates the need for a reserve account.

Permitting risk

Each market has its own permitting regimen. Permits may be needed for environmental compliance, factory operations, construction, air space, noise, forestry, and various other requirements. The permitting authorities may be both national and local. It is essential to understand the permitting processes and to allocate appropriate time for them. Some countries have streamlined permitting processes for small renewable energy projects, but it is a common misconception that environmental permitting for such projects will be easy simply because they are “green.”

Construction risk

The engineering, procurement and construction (EPC) phase of a biogas project requires an experienced contractor and proven equipment and component suppliers. Critical guarantees of milestones, such as project completion date, net kilowatt power output and the fuel heat rate based on local fuel parameters, need to be secured up front. Liquidated damages should be payable for missing any guaranteed parameter and should be sufficient to compensate for the resulting additional cost or loss of power output.

For example, liquidated damages for failure to meet the completion date should be enough to cover the additional interest cost incurred during construction. Liquidated damages for heat rate should compensate the owner for the net present value of additional fuel that will be consumed for the duration of the contract. In addition, the project owner needs to have enough equity in reserve to cover a cost overrun and still complete the project.

Typically, lenders require a lump sum EPC contract that provides a complete “wrap” of the construction of the project. Payment and performance bonds (or comparable standby letters of credit) may also be required by lenders.

Credit risk

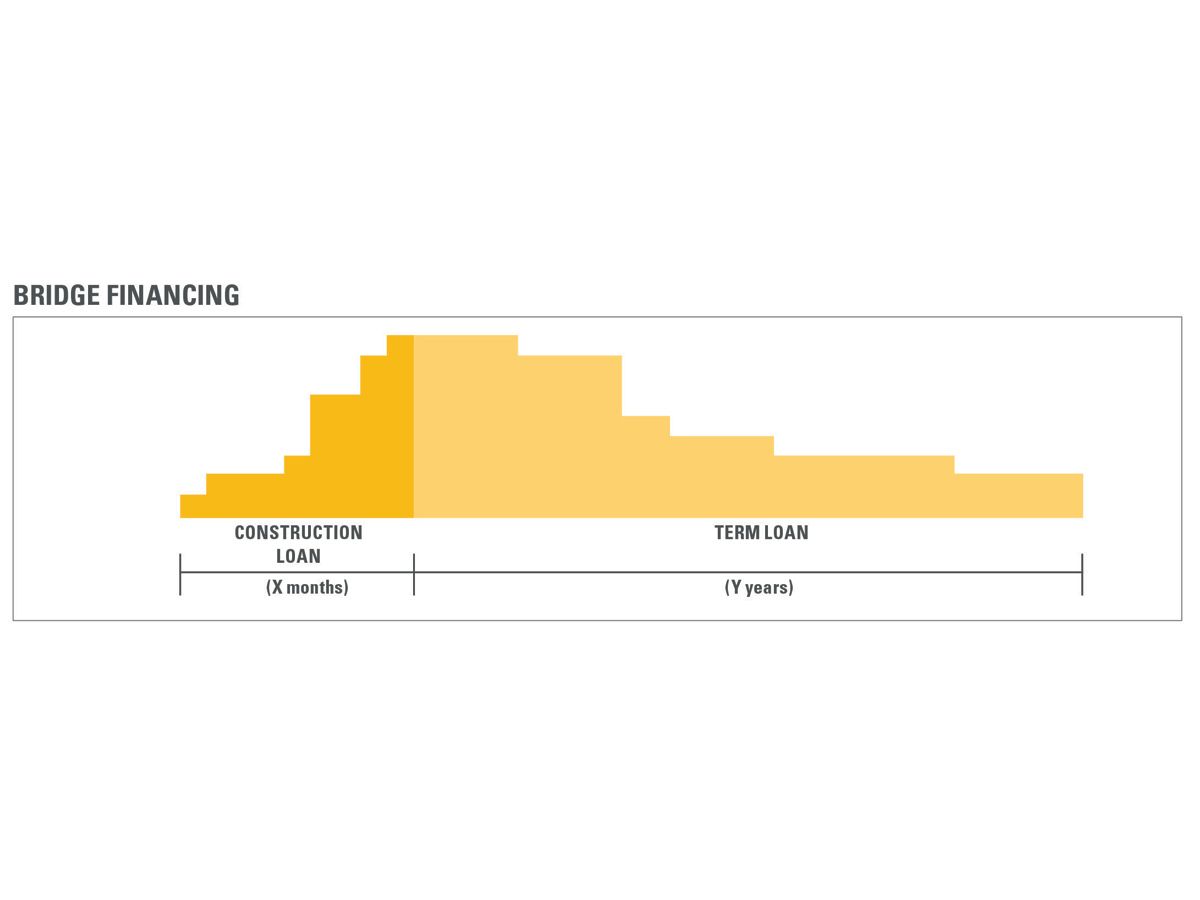

Financing is a key hurdle for any renewable energy project. The two basic forms of financing carry substantially different risks for both lender and project owner.

Balance sheet financing requires the company that owns the project to pledge, in effect, its “full faith and credit” toward it. Assuming the owner has a strong balance sheet, financing in this scenario should be relatively quick and easy to obtain: The lender derives comfort in the form of the company’s track record, assets, cash flow and profitability. That means lower risk and therefore generally a lower interest rate. However, some companies prefer not to carry energy projects on their balance sheet, operating them instead as separate business entities or contracting with third parties.

In such scenarios, non-recourse project financing is used. Here, no proven, stable parent company stands behind the payment Obligations of the project: its financial viability depends solely On the project’s own revenue, profit and cash flow. Given the Challenges of retrieving installed engines and ancillaries and the customized nature of electric power projects, even the equipment itself offers the lender little by way of collateral. Due diligence becomes much more stringent: Is a long-term power purchase agreement in place? How reliable is the supply of feedstock for fuel? Is there a supply contract in place? If so, for how long? Is the project developer experienced in the energy sector or with power generation? Because the review process is more involved and the risks greater, the interest rate and development costs generally will be higher.

Essentially, from a lender’s perspective, the difference between balance sheet and non-recourse project financing is like the difference between investing in a blue-chip company versus a startup company.

Insurance risk

The entire project must be adequately insured against physical damage and public liability for accidents, property damage and personal injury. It should also be insured against lost revenue from business interruption, such as from a storm, flood or fire.

Inflation risk

The financial model needs to include an adequate inflation factor covering both revenues and expenses. This should include inflation in construction capital costs as well as the long-term inflation that may affect operating costs, such as replacement parts, labor, rents and general expenses.