TRENDS DRIVING CHANGE

Traditionally, standby power has been a diesel market because diesel engine characteristics have inherently fit.

Diesel engines, with their high power density, offered low first cost and the capability to assume loads quickly during emergency startups. Operating cost was largely irrelevant because standby generator sets typically operate for less than 100 hours per year, and often only for periodic exercising. Additionally, emission requirements were easy to meet and not a major concern.

Meanwhile, gas engines, with lower power density and higher first cost than diesel engines, were designed for extended duty. In this application, fuel cost, maintenance cost and emissions were (and remain) the key concerns. However, recent events have exposed some limiting factors of diesel engines in certain applications.

For example, after major storms such as Hurricane Katrina on the Gulf Coast and Hurricane Sandy on the upper East Coast, diesel generator sets at certain sites did not operate through out the duration of the power outage. Some fuel storage tanks were compromised by flooding. In other cases, flooding or debris blocked streets and highways so that fuel trucks could not make deliveries, leading to fuel tanks running dry. Meanwhile, natural gas pipeline networks were minimally affected, if at all.

More broadly, diesel standby generator sets have been limited by emissions regulations, notably where air quality is not in attainment with U.S. Environmental Protection Agency (EPA) standards. In most localities, emissions from Tier 2 diesel standby engines are acceptable as long as they operate for 100 annual hours or less (excluding hours in actual emergency duty). However, in non-attainment areas, such as Los Angeles and New York City, EPA regulations limit sites to a maximum annual tonnage of NOx emissions.

Facilities with large standby diesel capacity may exceed the site emission limit and face significant fines, just for emissions from routine exercising. Even an upgrade to Tier 4 diesel technology, at much higher cost, may not provide a complete remedy. In such cases, the advantage of natural gas-fueled standby power is clear – today’s high-efficiency lean burn engines can operate for an extended time in full emissions compliance while meeting rigorous requirements for start time and load acceptance.

TRANSITIONING TO GAS STANDBY

Natural gas-fueled engines for standby power are not a new concept. For years, gas generator sets installed for load management (demand response) have done occasional double duty as sources of mainly optional emergency power. Similarly, gas generator sets for CHP are often on-line when standby power is needed.

These prime and continuous applications typically involve far more annual run hours than pure standby. Gas engines can deliver much cleaner exhaust emissions than traditional diesel technology without costly aftertreatment. Fast startups and rapid load acceptance are secondary in these settings.

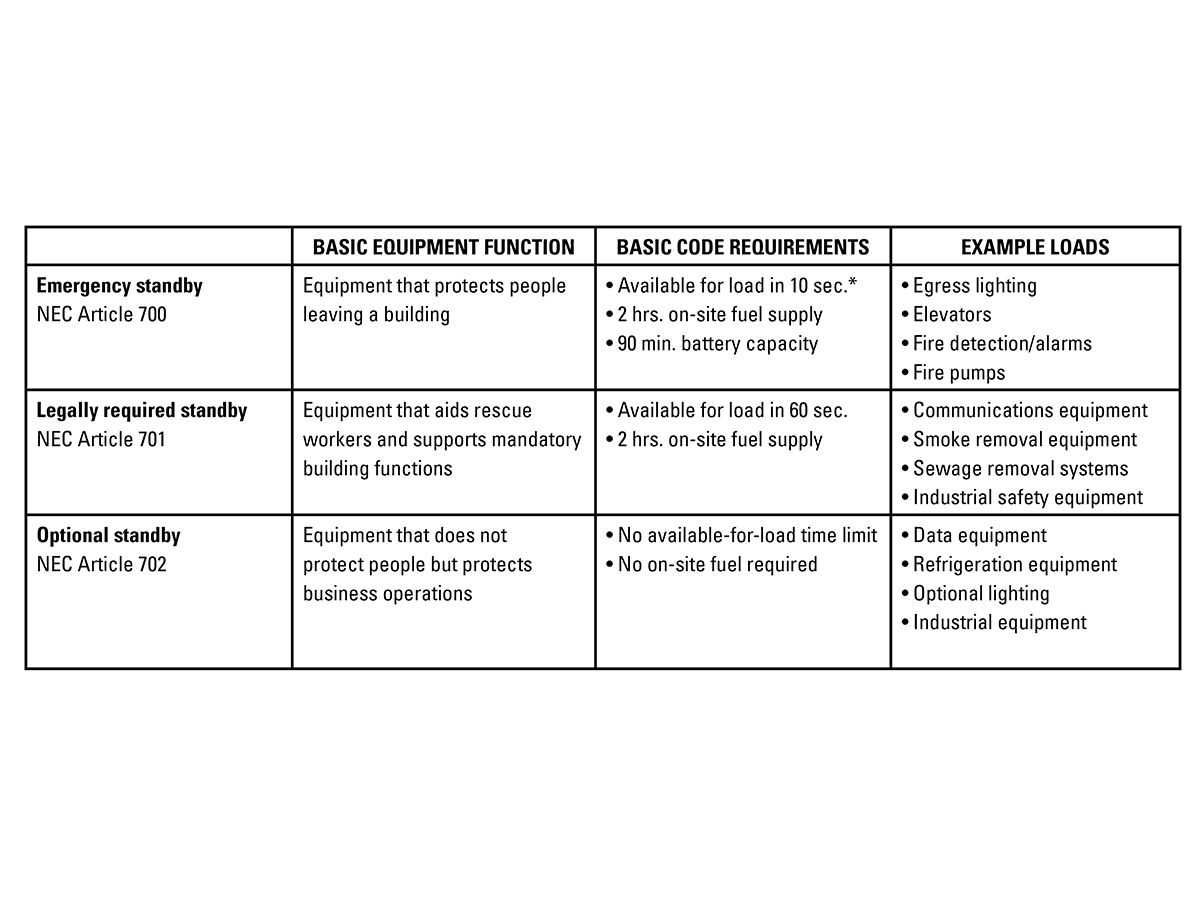

Gas-fueled generator sets are a new concept for pure standby duty, most notably in the high-growth segment at 500 kW and up. Here, gas generator sets must meet the same requirements as diesels for time to start and accept full load (Table 1).

The question then becomes how to reimagine natural gas engines to achieve diesel-like standby performance. This requires an understanding of the loads to be powered, and the capability required of the engine to pick up those loads with the necessary speed. Improved performance of the gas engine makes it comparable to the diesel engine. There is also a greater capacity to pick up loads, as well as improved voltage dip and recovery time.

Considerations include:

- Types of loads (lighting, computers, healthcare equipment, motors, UPS, chillers, compressors, fans, etc.)

- Linear versus non-linear loads

- Special load-starting devices needed (such as motor starters for large single-motor loads)

- Load size (both individual devices and the total load to be switched at one time)

- �Power quality required (voltage and frequency dip, recovery time, power factor requirements)

- Geographic/ambient conditions (altitude, temperature extremes and atmospheric conditions that may limit engine capability)

- Types and durations of emergencies likely to occur locally (storms, flooding, extended utility outages, etc.)

MEETING THE CHALLENGE

The challenge is how to produce natural gas-fueled standby engines/generator sets at prices acceptable to the market. Facility managers are reluctant to spend more than necessary on a mandated standby installation.

Gas and diesel engine manufacturers work hard to maximize power density (kW per unit of cylinder displacement) to lessen the initial cost of equipment. Gas engines, designed for extended-hours service at relatively uniform load and constant speed, traditionally operate at cylinder pressures significantly below their physical capability. For example, Caterpillar high-efficiency lean burn gas engines are built with essentially the same robust core components (engine block, crankshaft, connecting rods, cylinder block, valve train) as diesel engines. They clearly have the structural strength to accept higher power density and demanding standby performance without extensive redesign.

The task was to use the existing gas engines, with a knowledge of their limitations (such as detonation margin, fuel methane number, exhaust temperature and fuel pressure) and modify them to perform similarly to diesel engines for standby duty with fast starts, rapid acceptance of load and short-duration runs.

The essential question became how to force sufficient air and fuel into the cylinders rapidly enough to meet emergency standby performance requirements. Simply stated, this involved refinements of the fuel system, the air system, including turbochargers and, most significantly, engine management mapping strategies employed in the electronic control system. Electronic controls had to be developed to help gas engines do what they had not historically been designed to accomplish.

A key attribute in lean burn standby gas engines’ capacity to assume load is transient richening. Built into the engine’s electronic control strategy, transient richening greatly increases the fuel flow to the cylinders when a block load is applied, taking advantage of the excess air inherently present for lean burn combustion. When the block load has been completed and the engine has returned to normal operating conditions, the gas flow returns to normal and the lean burn, low-emission air-fuel ratio is restored.

With refinement of the transient richening process through the control system and the addition of quicker-acting air system components, gas engines can now deliver performance comparable to diesels in standby power applications. One remaining challenge was the impact of operating these newly refined standby gas engines at very light loads during routine exercising and testing – when engine manufacturers normally recommend loading gas engines to at least 50 percent of rating for such purposes. Newly designed Cat® standby engines are configured to allow for no load operation for up to one hour per month, provided maintenance practices are followed.

LEAN VERSUS RICH BURN

Both modern lean burn and older technology rich burn gas engines can be deployed in standby service. In most standby duty, lean burn technology has meaningful advantages. Traditionally, the rich burn engines had greater capacity to pick up loads, but more recently the lean burn engines are being purposefully built for improved load acceptance.

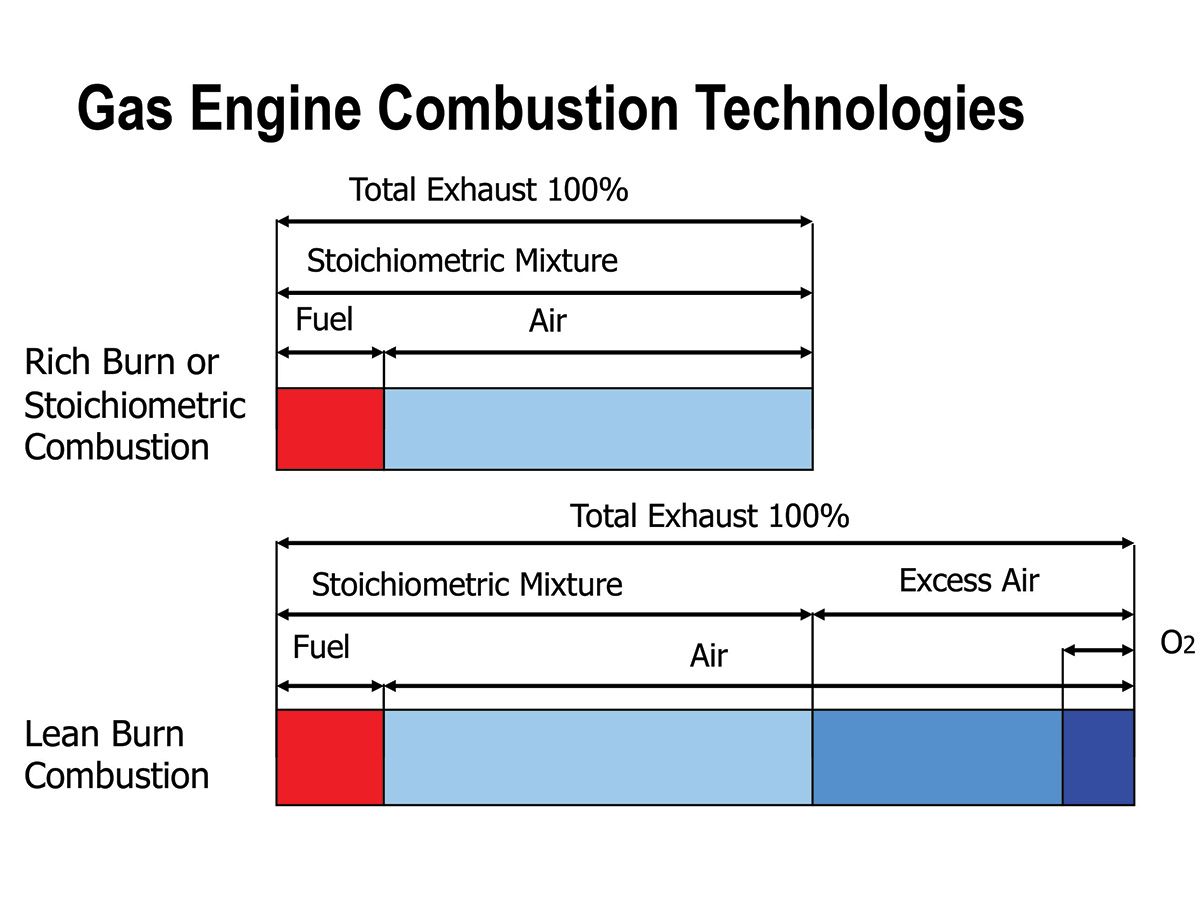

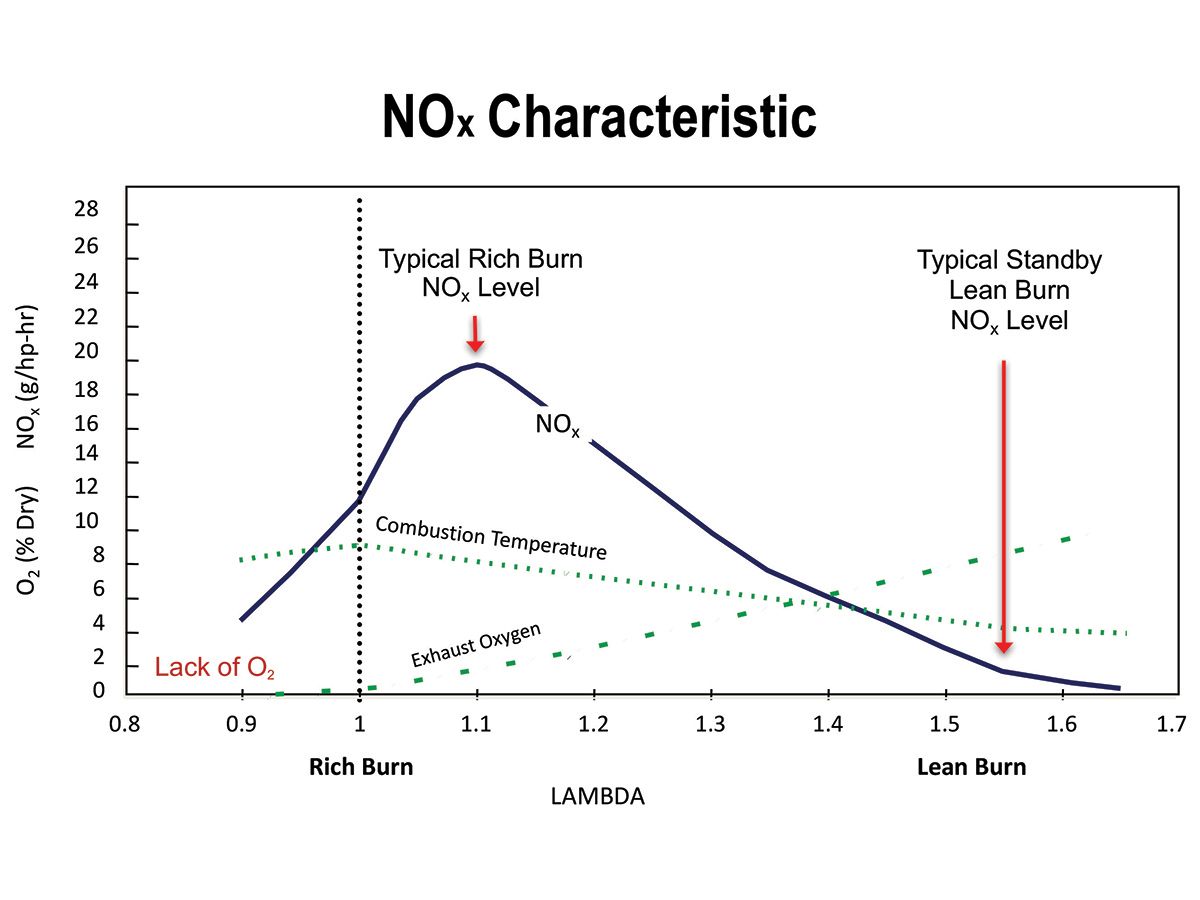

Rich burn engines represent traditional gas technology. Simple to operate and with relatively low first cost, they have proven reliable in many applications. A key limitation of rich burn engines is that their higher cylinder temperatures produce relatively high NOx emissions that need to be controlled with a three-way oxidation catalyst at additional cost to install and maintain. In addition, rich burn power density is limited due to higher exhaust gas temperatures. As shown in Figure 1, the lean burn engines have excess air in the cylinder that allows for lower exhaust temperatures, higher power density and lower NOx emissions. This leads to an improved fuel efficiency of 10 to 20 percent and improved power densities.

Since the 1980s, lean burn engines were designed largely to enable low NOx and other emissions without exhaust aftertreatment by lowering the internal cylinder temperatures, reducing the formation of NOx as shown in Figure 2. They also have higher power densities than rich burn engines, are more fuel-efficient and cost less to maintain. As the name implies, lean burn engines operate with leaner air fuel ratios in steady state operation.

COMPARING OPERATING COSTS

The choice of gas versus diesel standby power also depends on a comparison of first cost. Diesels at a Tier 2 level, where permissible under emissions rules, retain a first cost advantage over gas generator sets. But for sites that require Tier 4 diesel technology, the first-cost difference quickly disappears. In applications with first cost parity, gas standby engines have a long-term cost advantage by way of lower operating costs.

For example, while diesels generally require oil changes every 250-300 operating hours, depending upon the load factor, gas engines have oil change intervals of 1,000 hours and in some models much longer. That becomes significant after major natural disasters, when standby equipment may operate for a week, two weeks or longer before utility power is restored. Even during a standby power event, maintenance on generating equipment is still required at or near recommended intervals in order to maintain system operational integrity.

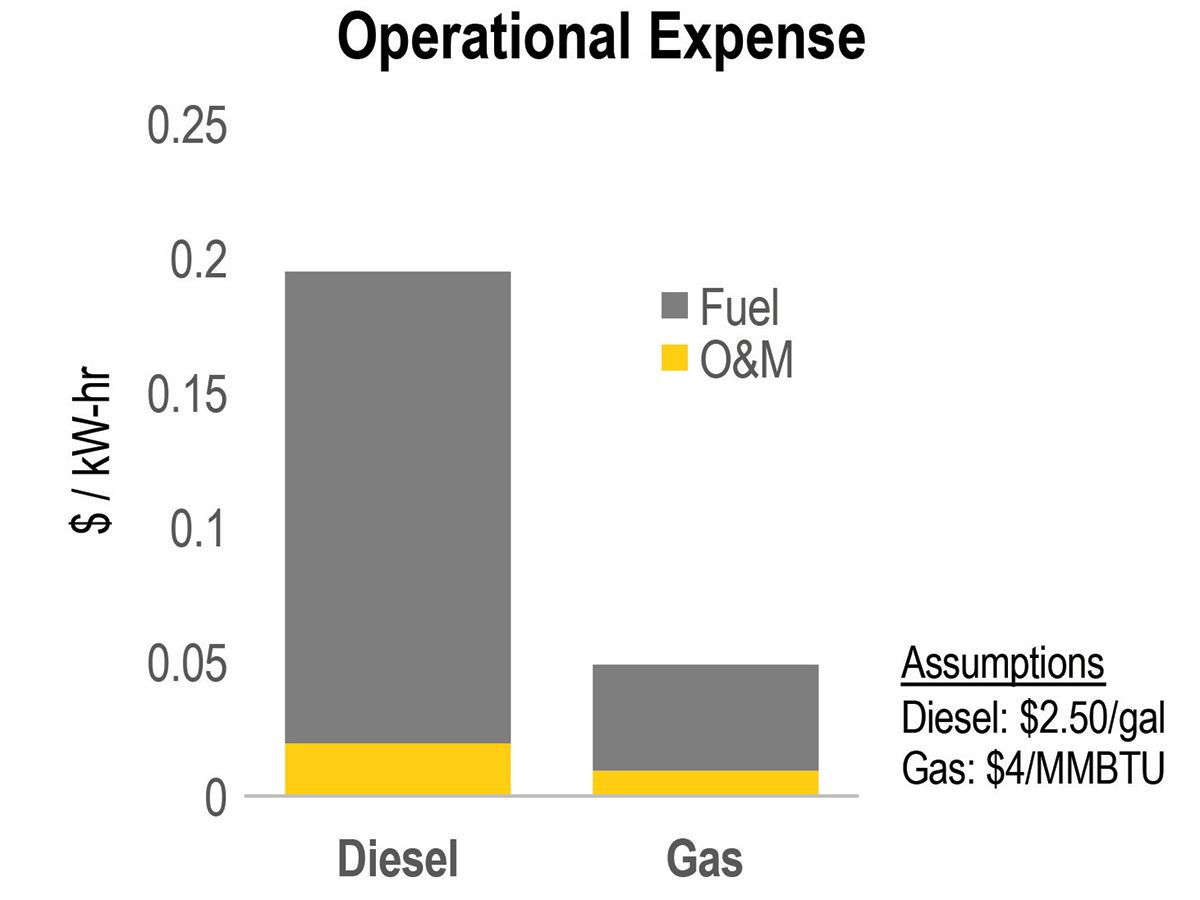

Fuel cost can also be significant, and not exclusively in times of extended standby duty. For example, consider a 1 MW diesel engine and a 1 MW gas engine operating for 100 hours in a year, with diesel fuel at $2.50 a gallon and natural gas at $4/MM Btu. For those 100 hours of operation, the gas engine’s fuel would cost about $20,000 less than that of the diesel (Figure 3).

The longer the operating hours and the greater the number of years in the evaluation period, the greater the fuel cost advantage of gas technology. In addition, there is the initial and long-term cost of on-site fuel storage. Diesel fuel is typically paid for when delivered to the site to be stored. Depending on the fuel volume, that can be a significant investment. In addition to the initial cost, the fuel needs to be maintained while in storage. This includes fuel polishing when needed, fuel storage additives, and tank and site maintenance and control. Natural gas, on the other hand, is purchased as used and does not require additional cleaning beyond the always-recommended in-line fuel filter.

CONCLUSION

When choosing natural gas or diesel standby power for a given application, it is helpful to consult with a dealer or representative of an engine manufacturer with a track record in the standby market. These professionals have access to engine generators in a broad range of power ratings and configurations and are experienced in both diesel and gas technologies.

They understand the needs of different commercial, industrial and institutional facilities and can help select the most appropriate standby system at the optimum installation, operating and maintenance cost. They are also familiar with standby power code requirements and the preferences of local AHJ.

Cat dealers can manage whole-project engineering, procurement and construction, and supply all engines, generators, transformers, switchgear and other ancillaries required. They also have access to manufacturer’s financing programs to help complete the project in a budget and cash-flow friendly manner.

The standby market continues to evolve toward natural gas-fueled standby engine technology. Gas engine development has quickly and successfully responded to the market’s need for low-emission engines capable of the fast load acceptance that standby service requires. Many facility operators now welcome natural gas generator sets as tools to meet the growing list of challenges in standby power service. To schedule a consultation, attend a webinar or have on-site training on this and other topics, visit cat.com/powersystemstraining.

ABOUT

About The Author

Diane Clifford is a Market Consultant in Caterpillar Energy Solutions located in Lafayette, Indiana.

About Caterpillar

For more than 90 years, Caterpillar Inc. has been making sustainable progress possible and driving positive change on every continent. Customers turn to Caterpillar to help them develop infrastructure, energy and natural resource assets. With 2017 sales and revenues of $45.462 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company principally operates through its three primary segments – Construction Industries, Resource Industries and Energy & Transportation – and also provides financing and related services through its Financial Products segment. For more information, visit caterpillar.com. To connect with us on social media, visit caterpillar.com/social-media.