Read the full episode transcript

00:00:00 Jordan Yates

This episode of the Energy Pipeline is sponsored by Caterpillar Oil& Gas. Since the 1930s, Caterpillar's manufactured engines for drilling, production, well service, and gas compression. With more than 2, 100 dealer locations worldwide, caterpillar offers customers a dedicated support team to assist with their premier power solutions.

00:00:26 Wayne Zemke

The Energy Pipeline is your lifeline to all things oil and gas to drill down deep into the issues impacting our industry. From the frack site to the future of sustainability, hear more about industry issues, tools, and resources to streamline and modernize the future of oil and gas. Welcome to the Energy Pipeline.

00:00:49 Jordan Yates

Hello everybody. Welcome back to another episode of the Energy Pipeline. It's me, your host, Jordan Yates. And today, we have the privilege of featuring Steve Glanville, the president and CEO of STEP Energy Services. We are also joined by one of our co- host, Wayne. Today, we're going to explore step's innovative operations and highlight their Tier 4 Canadian Fracturing Fleet Upgrade Program. That was a mouthful. Steve, say hello to everybody.

00:01:20 Steve Glanville

Yeah, good morning everyone, and thank you Jordan and Wayne for hosting me on this podcast. I'm pretty excited about understanding a little bit more about, I guess, sharing a little bit about our business and our technologies. And yeah, thank you for having me.

00:01:35 Jordan Yates

We are excited to have you here. Wayne, say hello to everybody. It's been a few episodes since they've heard from you.

00:01:40 Wayne Zemke

Yeah. Hello, everyone. Good morning and good afternoon. It's good to be back with you.

00:01:44 Jordan Yates

But you didn't say that you missed them. He missed you. He was telling us off- air. Steve, we want to get straight into your background and learn a little bit more about your journey in the oil fields industry and what led you to become the president and CEO of STEP Energy Services. Can you tell us more about that?

00:02:01 Steve Glanville

Yeah. I started at the very beginning. I guess, I was a farm kid growing up in Northern Saskatchewan, which is of course is very, very highly productive agricultural area in Canada. And however, when I turned 18, my dad said, " There's just not enough income for two of us, so you need to leave." And so I ended up getting or applying to SAIT, which is a technical college here in Calgary, Alberta. And I received my petroleum engineering technology diploma at that point. And I was able to get recruited by a company called the Schlumberger, which is a course called Schlumberger or SLB today. And so I spent 10 years working for them. Great amazing company and obviously lots of strengths that they have in engineering and technology. I guess, it's probably, I would say, the foundation of the impetus of starting STEP had a lot to do with my training at Schlumberger and then worked for a few smaller companies all directly related to completions or upstream side of the business fracturing or pressure pumping and coiled tubing. And then in 2011, there was an opportunity that came up in front of me to me and two other co- founders of STEP Energy Services had an opportunity to start our company. We had some seed capital given to us and the thesis behind the business was to build deep capacity coiled- tubing units to really keep up with the longer reach or longer lateral wells that were being drilled in the Western Canadian Sedimentary Basin. Fast- forward a few years, we decided to get into the pressure pumping business by buying two companies out of bankruptcy protection. One was called GASFRAC. The other was called Sanjel. So that really got us into the pressure pumping business. And at the same time, we decided to move some of our coiled- tubing assets into the US in the Texas area. We IPO the company, so we're listed on TSX. In 2017, we expanded our pressure pumping business by buying a private company out of Oklahoma called Tucker Energy Services. And fast- forward to today, we are about, call it, 1, 450 employees North American wide. We really offer the largest deep capacity coiled- tubing company in Canada and the US and we have a very, very strong presence in the pressure pumping business, particularly here in Canada. And we're focused in West Texas with our pressure pumping fleet in the Permian Basin. So that's a little bit about ourselves in a big mouthful.

00:05:05 Wayne Zemke

Steve, I think it's a great story of success. Can you share a little bit about what you're doing with your Tier 4 Canadian Fracturing Fleet Upgrade Program and how has that been significant in the growth and the transformation of STEP's business?

00:05:19 Steve Glanville

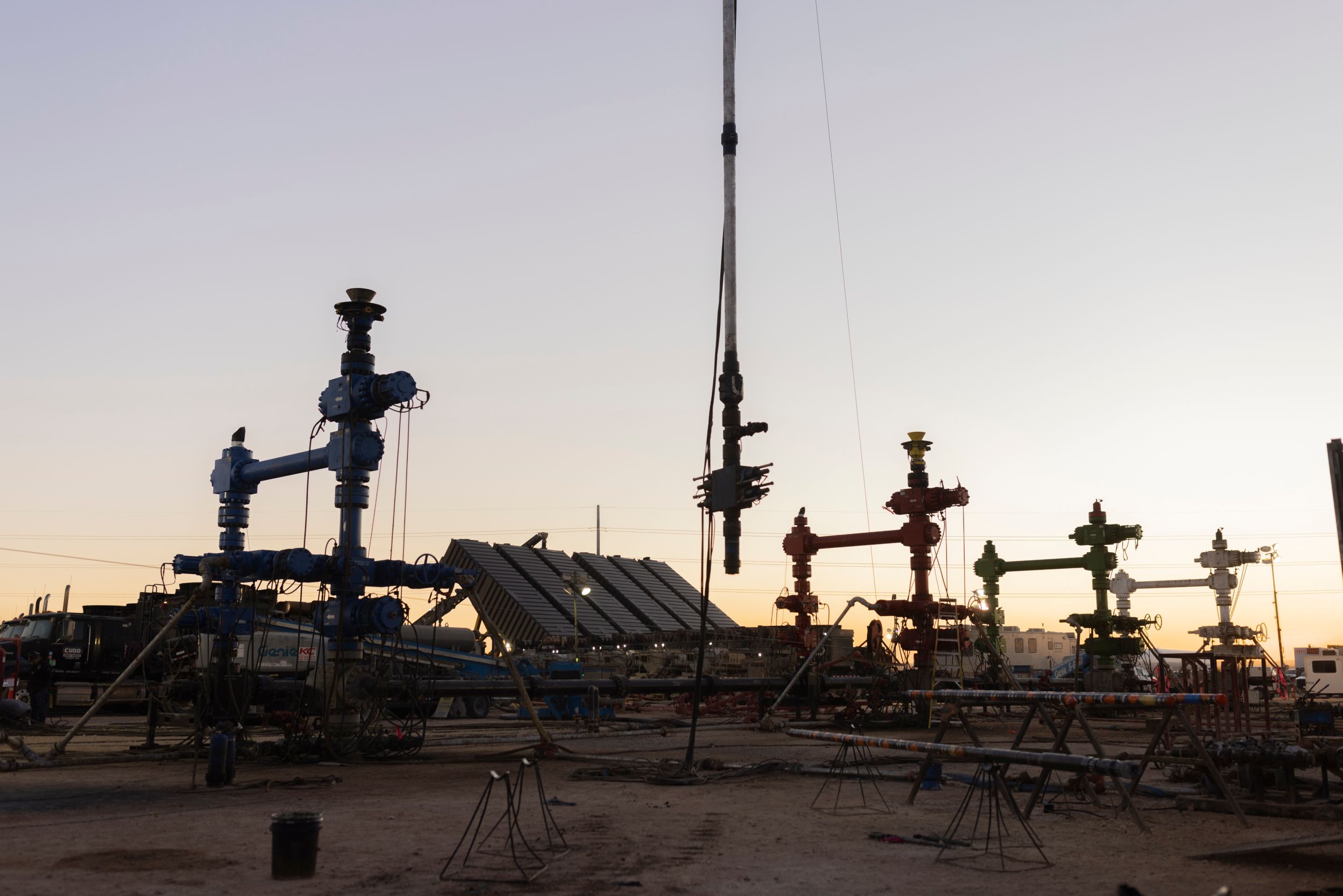

Yeah, Wayne, we've been using primarily the Cat lineup that we have here in Canada. We have a, call it, 300,000 horsepower of Tier 2 engines that we purchased kind of through these two acquisitions of Sanjel and GASFRAC. And there's a cycle that these fracturing pumps, particularly the capital components such as the engines go through, and it's usually about a 20,000- hour retirement program that we have. And so this technology that Caterpillar offered was a really... I wouldn't say a quick bolt- on, but it was able to refurbish an asset base that required some upgrading. We were able to do that obviously, and they're working in the field today. We have a fleet of 17 pumps that are working in the field today and we're having great success.

00:06:19 Wayne Zemke

And maybe for some of the listeners that don't know, what does Tier 4 mean and what did you have before and what makes Tier 4 better or more transformative?

00:06:28 Steve Glanville

Yeah, I mean the Tier 4 engine, I believe it was developed probably five or six years ago, and it's really just increasing the standards from an emission standpoint. And it's kind of a dual- fold. You get greater emission reduction with this engine from greenhouse gas and NOx in particulates, but also the added benefit with a Tier 4 as we've added dual fuel kits. So dual fuel kits allows you to run not only diesel but also natural gas. And with the newer technology of the Tier 4 engines, we're able to get up to 80 to 85% substitution of our diesel. So huge benefit of course with us and to our client.

00:07:17 Jordan Yates

Yeah, yesterday to prep for this episode, I was talking to somebody on the STEP Energy Services team, Christine, and Christine was telling me like, " Hey, a lot of this episode we're about to talk about focuses on ESG, but that's just barely the tip of our value proposition." She was saying, " You guys are very into cost savings for your customers and your reliability and just overall operational efficiency to the point where even once you get your materials from manufacturers like Caterpillar, you guys take it a step further in the innovation and the process to where you are almost teaching them how to make their products better." Can you tell us a little bit more about that and how you all are so innovative?

00:08:02 Steve Glanville

Yeah. I would say that the shale revolution of our industry has evolved in kind of a short time period. It's really only been, call it, the past decade that we've been able to obviously produce resources in the ground and doing it better than we ever have been this industry has. And what we've done is looked at the product looked at every minute that goes into our day. And to us, it's about efficiency. How do we provide a service and a product that our clients are seeing the value of? And it's really uptime. We measure every, like I said, minute of non- productive time, every minute of pumping time. So it's allowed us to really look inside of our business using data, and we've been able to incorporate a number of technology pieces to our asset base, which of course not only reduces emissions, for example, like we've introduced a idle reduction kit. And what that is very similar to your pickup truck or your vehicle that you drive at a red light. It shuts off. And in the past, we've had our assets idling probably 30 to 40% of the time the life of the engine. Now, we have that ability, it shuts off when it's not in use. So that's adding obviously longevity of the capital asset, but also reduces emission. And I would say the second most important part is really the preventative maintenance that we've added. It allows us for increased uptime of our assets, increased uptime of our operations. And at the end, it provides a better margin for us and a better return for our client.

00:09:55 Jordan Yates

I love preventative maintenance. Anytime somebody prioritizes that, it's like, " Thank goodness," because I know some people will see that as like, " Oh, that's an extra step. I don't want to have to do that because why not just leave it as is and let the customer deal with it?" But the fact you're putting the forethought into that makes me feel very confident in your knowledge and the fact that you guys really do understand your value proposition. Wayne, what do you think about all that?

00:10:22 Wayne Zemke

Well, no, I think it's a great story. Steve, I'd like to understand how you've taken the expertise that your company has developed and some of that knowledge and use that to collaborate with ENPs. I understand that you have a program or a partnership with a leading ENP. Can you talk a little bit about what that is and how you've brought the skills and the knowledge that you just described into that partnership?

00:10:43 Steve Glanville

Yeah, really unique partnership, Wayne, that we have, but I'll just kind of back up a little bit that our business, our industry, the pressure pumping business has really had a lack of capital discipline. And what that means is when oil prices ramp up and clients want to go ahead and drill, it's really easy for the service industry to be enticed on bringing brand new assets to the field. If you can think about just like today's dollars, it's about$ 60 million to get a fracturing fleet out in the market today. And that payback, of course, you model it out, we hope we get a payback of call it under 10 years is ideal. But how we've structured this agreement has a lot to do with the longevity of the partnership that we've had with the company's called New Vista. They're kind of a mid- cap ENP here in Canada. We've been working with them really since we started the company and they value what we bring to the well site from a safety perspective, but also from an efficiency perspective. And we approached them really about a year ago, a year and a half ago, and talking about this new technology and how this would really help them with their program, reducing their overall costs, increasing their reduction of emissions. And so this partnership, we struck the deal back in September of'22. It's a three- year deal. And yeah, we're really happy with how that's turned out. And like I said, we kind of started rolling assets out really at the end of'22 and we had everything completed by June of 2023. So really happy on the performance.

00:12:39 Jordan Yates

I love how you said that you guys are kind of watching when oil prices are up, people are making a lot of money that you're kind of like, " Hey, let's not just spend a lot," because I personally am so guilty of that. I am the classic person, I make some more money. Girl, I'm spending more money, there it goes. And then all of a sudden it's like, " Why am I not saving? Why am I not prepared for a crisis?" So the fact you think about that, because I see it as a fun part of the oil and gas industry, I'm like, " We just throw money around," it's crazy, but that's not exactly great business practices. So to have someone like you guys as a partner is very beneficial, I can imagine to their strategy. And I'm kind of excited that this leads us into the next question, which is so on point, which says, the program that you guys have incorporates cost and availability certainty for the producer. Could you elaborate on how the pricing is linked to commodity prices and the mechanisms in place to manage cost inflation risk?

00:13:38 Steve Glanville

Yeah, it's a bit complex. I don't want to get into a whole bunch of detail, but the structure was kind of set up that we would have a prepayment from New Vista and that provided a little bit of teeth in the contract. And of course, what we like about this contract, it is linked to WTI pricing, so it's an index on WTI. So as WTI increases, of course, we're able to gain better margin in the business and everybody wins. And of course, when WTI drops a little bit, we're able to shave a bit of our costs and allows them to continue to operate and finish their capital program. So it's kind of a three- year outlook and it's locked in basically. And we're really happy with the margins that we are receiving.

00:14:36 Wayne Zemke

Well, that's really interesting and innovative and I think often about how shales are such a short cycle business with these ups and downs. And it sounds like you found a way to mute some of those impacts and still successfully go forward with business.

00:14:53 Steve Glanville

Yeah, Wayne, as I'd mentioned, we've been investing in Tier 2 dual fuel for quite some time, and with that we've kind of built a software that allows us to get maximum natural gas substitution to our engines. We've rolled that into... So it's the proprietary system that we use, we've rolled that into the latest Tier 4 technology. And what we're seeing is on a full year of using this asset base, our clients can save up to 10 million of diesel costs. And of course, that's a big driver of our clients wanting to use this newer asset base, but also, it's a dual fold with reducing emissions. And of course, we're seeing more and more regulations that, I think, our industry obviously needs to be in the forefront of, and this technology allows us to do that.

00:15:50 Jordan Yates

Saving$ 10 million is a lot. That's awesome, for sure. And then when you're also helping them be better for the environment, it seems like a win- win all around. It seems though that you guys also have some industry leading, if you will, Tier 2 dual fuel kits. How are these contributing to your goal of, I believe, having 65% of your asset base being dual fuel capable by the end of 2023. Is it?

00:16:23 Steve Glanville

Yeah, that is correct. We will have 65% of our assets that are pressure pumping assets that will be on natural gas. And I think one thing that our clients, our ENP companies are getting really great at, and that is providing natural gas back to the well site. So it's not being carted by a CNG trailer or LNG trailer, it's actually plumbed really from the plants back to the well site. And you think about some of these wells or paths that we're working on, we're there for upwards of 60 days on a well site. And when you can have natural gas being used primarily as a fuel, it's a big savings. And when I talk about our Tier 2 technology, we differentiate ourselves to our clients with that technology. And it's really due to that pressure pumping software that we have, it ties within our whole fleet and it's really setting the optimization to get these engines working at a higher natural gas.

00:17:34 Jordan Yates

I'm just going to ask maybe a dumb silly question, but maybe in case the audience doesn't understand. So you're having these dual fuel ones, you have diesel, you have natural gas. Why is diesel still there? Is it because it's more robust, it's stronger, it's better? Where do you find that balance and what's the benefit of both fuel types?

00:17:56 Steve Glanville

Yeah, we think there's a market for diesel fleets. I believe there always will be. We have clients that probably don't have the infrastructure set up, so maybe some smaller ENP companies. And so we do believe that there's a market for that. Diesel is obviously extremely flexible. We carry it on our units itself. And as I mentioned, you don't need that infrastructure like what we see with a lot of the larger ENP companies. So I believe that there's still a market for that when you look at the overall US market and Canadian market in that fact, it's leading more towards how do you get as efficient as possible. And from a cost saving perspective, it's really the main driver behind this.

00:18:44 Jordan Yates

Thanks for answering that. I know that wasn't a question we gave you ahead of time, but as we were going through, I was just like, I wonder sometimes I forget this is an educational podcast and I like to assume that maybe our listeners don't know everything about every technology. Sometimes, I have to bite the bullet and ask the questions because for me, I mean if I'm being honest, I'm not an expert at that either. So I like to know more about it. I did mechanical engineering at school and I should know all these engines a lot better. But man, it has been a long time and I do not remember everything.

00:19:20 Steve Glanville

There's been a lot of technology, Jordan, that's been implemented not only in our industry. Of course, you drive an automobile and the technology is staggering where you can let go of a steering wheel now and it will take you from point A to point B. So I'm not quite trustworthy of that yet.

00:19:35 Jordan Yates

I mean, I almost am because I think that it's probably better than I am at driving. I mean, if it can stop hitting curbs for me, I am in, I'm sold, but for now I'm steering my own car. But anyways, Wayne, get us back on track. What's the next question?

00:19:54 Wayne Zemke

Well, yeah, Steve, I'd like to understand as you talk about natural gas as a fuel and the flexibility that comes with that, what is STEP Energy Services vision around helping the energy industry not only meet global demand, but promote some of the environmental stewardship that's so important to what we talk about?

00:20:18 Steve Glanville

I think this is a global challenge that we have as our industry and even as consumers of product. And to me, if I know I'm getting natural gas or even fuel from North American sources versus global sources, I know it's at a higher standard and we have a huge benefit. And it really comes down to our natural resources that we've been able to extract. They're prolific. They're long- lasting. And having the ability to provide that to the rest of the globe is really important. I see a lot of investment being put into obviously LNG in the US. It's going to be quite remarkable over the next, call it, five years to the end of this decade on how much LNG is going to be exported out of the US. In Canada, we're just starting that right now. We're a few years behind the US on exporting our natural resources, liquefying natural gas and setting it over to other markets. And I think, I don't know, I look at it as a... It's a global crisis. If you want to look at it as a crisis from a climate change perspective, and we need to do our part. People aren't going to stop using energy. We need to create low cost- efficient and green energy. And I think North America is set up the best position of anybody to provide that, too.

00:21:57 Jordan Yates

I really love natural gas. I think when I first got into the oil and gas industry, I really didn't understand it. I'm like, " Don't we just want oil? What's up with the gas? How does that work?" And now it seems that natural gas, I mean, it's always been prevalent, but it's becoming more and more a part of the conversation to where, I mean, maybe in the next 10 years it's going to be the gas and oil industry. I guess, we'll just have to wait and see there and change those around.

00:22:23 Steve Glanville

Yeah. Maybe. Yeah, I agree with you, Jordan. It's a fuel that we have an abundance of... And I just think deep down, we need to use more of it. And we're starting to look at straight natural gas- driven engines, not only on our equipment that's stationary in the field, but also our rolling stock up and down the road. If we can convert that to natural gas, I think those technologies that we're looking at right now.

00:22:52 Jordan Yates

That sounds very exciting. So we have a question about your latest innovations in engines and frack pumps because you guys are showing commitment to staying at the forefront of technology in this industry, if you will. Can you share any future plans or initiatives that you guys have coming up with the thought of operational efficiency or sustainability in mind?

00:23:18 Steve Glanville

Yeah. I mean, we have a team of professionals, and I just want to clarify the word professionals. We use that throughout all of our organization. It is something that we use as a tagline. We believe people that work for STEP are in a different category than our competitors. I'll stand by that today. So we use the word professionals often and we've been looking at a lot of things to really improve our efficiencies on every facet of our job using AI technology using, like I mentioned before, categorizing every minute of a 24- hour day and how do we get the most efficient operation. We're pumping on average 22 hours a day. And when you back up two years ago, we were seeing 17, 18 hours a day and two years prior to that was 13, 14 hours a day. So when you look at it, we're doing more with less time and with the same asset base. So I believe with the asset base that we have currently today, we can get up to 80 to 85% utilization on that asset base. And that will obviously provide shareholder return for our shareholders as well as create a extremely efficient business.

00:24:45 Wayne Zemke

Well, at the risk of channeling my inner Jordan Yates.

00:24:49 Steve Glanville

Oh, no.

00:24:50 Wayne Zemke

She often says, " I love to hear that." But Steve, I love to hear how you've talked about data, you've talked about technology, you've talked about some of the maintenance practices and the expertise. You just touched on your workforce. How do you envision the oil and gas industry evolving? And then what role does STEP Energy Services play in driving positive change?

00:25:15 Steve Glanville

Yeah, God, that's a big question, but Wayne, I really think if I were to kind of dream a little bit, what does the future look like? Labor has obviously been a big challenge for our industry and it has a lot to do with the cyclicality of our business. It's busy one minute. The next minute, of course, it drops and it's not sustainable in today's labor market. And so for us, it's, " Okay, how do we create a longer future?" And that's contracts like what we've set up today with New Vista and others. It provides that stable environment, but I see us looking at AI technology to perhaps reduce some workforce on location, perhaps look at ways to really automate processes to be completely automatic. And I think that gives you a better product at the end of the day.

00:26:24 Wayne Zemke

Well, you might've felt like it was a big question, but I think you gave us a big answer into the future there. Jordan, any thoughts or follow- up?

00:26:34 Jordan Yates

I love to hear that.

00:26:35 Steve Glanville

I just want to add one of our coiled- tubing units that we just built not too long ago, we've designed it to operate on a computer in a desk in Calgary. We haven't done that yet, but ideally, that's where you want to get to and you can kind of create a standard process. And our industry has been plagued with not training properly. I believe that we are way beyond that today. We've put a lot of time and resources into training and we have an extremely high retention rate within our company. But I think the next step is really how do you create these assets to be able to run just on its own with the parameters put in place. So I think that's where we're going to see the next kind of five years of business.

00:27:28 Wayne Zemke

That's really exciting technology and thanks for sharing that here with us on this pod today.

00:27:32 Jordan Yates

I know, I feel like-

00:27:33 Wayne Zemke

Automated coiled tubing.

00:27:34 Jordan Yates

I feel like everyone's going to be like, how can I be a professional at STEP Energy Services? Where's the link to apply? I feel like you guys sound like a really cool company to work for, and you're on the forefront of so much innovation. It's very exciting. So I like seeing that in our industry. And I think something that really hits home for me is the fact that you guys aren't only so concentrated on the actual product development, but the whole business aspect of it too, and making sure that it's a sustainable business model and being aware of the fluctuations of the industry. So to me, that just speaks so much to your guys' competency. And like you said, you guys are, what was it, a step above the rest, something like that. Is that why you're STEP Energy Services? I don't know, but I like it.

00:28:27 Steve Glanville

Yeah, our four core values are kind of made up of our name step and it's safety, trust, execution, and possibilities. And we use the word possibilities quite often as well as it gives you that opportunity to dream a little bit. And we have a very, very eager team and engaged workforce, and I'm extremely, I guess, grateful to be in a position that we are today. We went through some tough times with COVID the whole industry had and absolutely excited about the future with the company and industry.

00:29:00 Jordan Yates

That's great. Well, Steve, thank you so much for coming on the Energy Pipeline and allowing us to get to know you all and teaching our listeners more about these cool technologies. Wayne, thanks for being on today. Guys, I hope you enjoyed this episode and we will see you next time on The Energy Pipeline.

00:29:19 Wayne Zemke

Come back next week for another episode of the Energy Pipeline, a production of the Oil and Gas Global Network. To learn more, go to oggn. com.