Vous pouvez maintenant créer un compte pour gérer vos préférences et personnaliser votre expérience sur Cat.com.

Bonjour ! Puisque vous avez déjà un compte Caterpillar, nous avons automatiquement activé votre accès à Cat.com.

Bonjour ! Cat.com a été en mesure de récupérer votre profil Caterpillar, mais a besoin de quelques renseignements supplémentaires. Veuillez examiner votre profil et fournir toute information manquante.

Bonjour ! Cat.com a été en mesure de récupérer votre profil Caterpillar, mais a besoin de quelques renseignements supplémentaires. Veuillez examiner votre profil et fournir toute information manquante.

-

personclear

personclear

- place Trouver concessionnaire

-

Se connecterCompte

Effectuez l'enregistrement dès maintenant

Un seul compte. Pour tout Cat.

Votre compte Caterpillar est le seul compte à utiliser pour ouvrir une session dans les services et applications que nous offrons. Magasinez des pièces et des machines en ligne, gérez votre parc de véhicules, passez en mode mobile, et plus encore.

-

Découvrir nos produits

https://wwwqa.aws.cat.com

-

Acheter en ligne

https://qa3shop.cat.com/ShopLandingPageView?storeId=11751&langId=-2

-

Rechercher du matériel d'occasion

https://catused.com/

-

Produits de location

https://wwwqa.aws.catrentalstore.com/fr_FR/home.html

-

Gérer mon parc machines

https://my.rd.cat.com

-

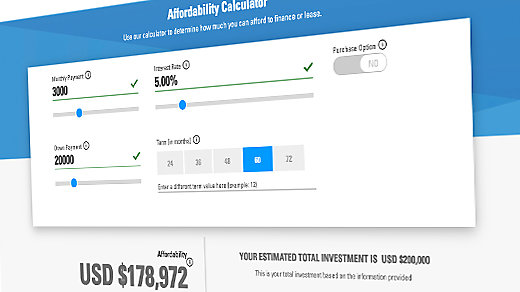

Voir les solutions financières

https://www.cat.com/en_US/support/financing-protection.html

Sites CAT

Effectuez l'enregistrement dès maintenant

Un seul compte. Pour tout Cat.

Votre compte Caterpillar est le seul compte à utiliser pour ouvrir une session dans les services et applications que nous offrons. Magasinez des pièces et des machines en ligne, gérez votre parc de véhicules, passez en mode mobile, et plus encore.

Votre concessionnaire préféré a été défini.

Souhaitez-vous également définir ce concessionnaire sur votre compte?Localisateur de concessionnaire

Actuellement, les tombereaux spécialisés CAT sont disponibles uniquement aux États-Unis et au Canada. Vous ne trouverez pas de tombereau spécialisé ailleurs.

Localisateur de concessionnaire

Retour aux résultats

Votre concessionnaire préféré a été défini.

Souhaitez-vous également définir ce concessionnaire sur votre compte?Localisateur de concessionnaire

Retour aux résultats

Vous quittez Cat.com

Notez qu'en saisissant des données dans cette application afin d'obtenir un itinéraire, vous fournissez ces données directement à Google LLC et/ou à ses filiales. En cliquant sur « J'accepte » ou en utilisant la fonctionnalité Google Maps pour obtenir un itinéraire, vous reconnaissez et acceptez que l'utilisation de Google Maps est soumise aux Conditions d'utilisation Google Maps/Google Earth supplémentaires alors en vigueur à l'adresse https://developers.google.com/maps/terms-20180207#section_9_3 et à la Politique de confidentialité Google accessible à l'adresse https://policies.google.com/privacy

You're Leaving Cat.com

Note that by entering data in this application for purposes of obtaining driving directions, you are providing such data directly to Google LLC and/or its affiliates. By clicking "I Agree" or by using the Google Maps functionality to obtain driving directions, you acknowledge and agree that use of Google Maps is subject to the then-current Google Maps/Google Earth Additional Terms of Service at https://developers.google.com/maps/terms-20180207#section_9_3 and Google Privacy Policy at https://policies.google.com/privacy